Advertisement|Remove ads.

Levi's Q1 Print May Offer Clues On Tariffs Resilience: Retail Sentiment Steadies

Levi Strauss & Co (LEVI) will report quarterly earnings after market hours on Monday, with analysts eyeing updates on its turnaround strategy and demand trends even as the sentiment among retail investors steadies to neutral.

Adjusted net sales in the first quarter is expected to drop 1% to $1.54 billion, according to analysts' estimate from Koyfin.

Adjusted earnings per share is expected to drop to $0.28 from $0.26 a year ago.

The report comes amid a substantial drop in the company's shares in recent weeks, in line with a broader market selloff triggered by U.S. trade tariffs.

Levi’s stock fell 11.5% last week to its lowest levels in 16 months, marking the sixth week of declines.

Donald Trump’s sweeping tariffs, announced last week, have added pressure to an already soft business, weighed down by intense competition in the apparel space and consumers spending modestly and selectively during high inflation.

In January, Levi’s forecasted a 1% to 2% drop in reported net revenue in 2025 and a 3.5% to 4.5% growth in organic revenue, which does not include the impact of divested business and foreign exchange rates, according to Reuters.

The company's adjusted profit per share forecast of $1.20 to $1.25 for the year missed analysts' target.

The management said the forecast was conservative, given the uncertainty from the tariff policies. Analysts believe Levi's limited exposure to China, Mexico, and Canada could lessen the impact.

A month later, the company announced a new chief supply chain officer position and additional responsibilities for some senior executives.

Levi’s is also reviewing options for its Dockers brand, including a potential sale, and investing to improve its store experience and supply chain.

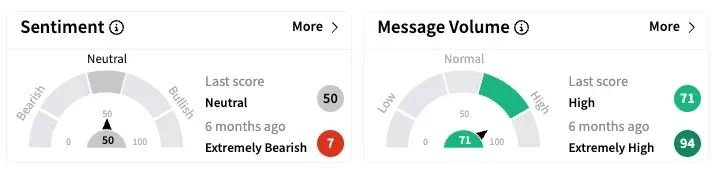

On Stocktwits, retail sentiment improved to 'neutral' from 'bearish' a day prior, while message volume remained 'high'.

A user said Levi's appeal comes from the fact that insiders hold the majority of its shares and its products are primarily made in the United States.

LEVI shares are down nearly 20% year to date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)