Advertisement|Remove ads.

Levi’s Stock Jumps After-Hours On Strong Q1 Print: Retail Cheers Tariff-Proof Gameplan

Denim giant Levi Strauss & Co. (LEVI) was not stretched too thin amid Monday's market mayhem as it posted strong quarterly results and stuck to its full-year outlook, saying it was working on strategies to counter President Donald Trump's steep import tariffs.

Shares jumped 7.4% in after-hours trading after closing about 3% lower in the regular session, following the first-quarter (Q1) report and boosting sentiment among retail investors.

Levi's said it had set up a team to understand the implications of the new tariffs and is considering plans for cost savings in the business and selectively raising product prices.

It noted that consumer demand was resilient so far.

Levi's kept its outlook for fiscal 2025 revenue and profit unchanged, excluding the impact from tariffs, and said it expected a minimal margin impact in the second quarter.

In Q1, which ended March 2, Levi's made a profit of $135 million, compared with a loss of $10.6 million a year earlier.

Excluding one-time items, earnings were $0.38 per share, above a FactSet estimate of $0.28.

Revenue rose 3.1% to $1.53 billion, excluding $67 million of revenue from Dockers after being reclassified as discontinued operations, boosted by a 6% increase across its core Americas region.

Analysts had predicted total revenue of $1.54 billion.

Levi's was among the top 20 trending tickers on Stocktwits as of late Monday.

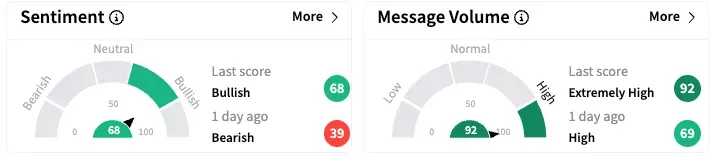

The sentiment among retail investors on the platform turned to 'bullish' from 'bearish' a day prior, and message volume jumped to 'extremely high.'

One used bullish watcher said that Levi's, thanks to its diversified supply chain, is relatively insulated from U.S. tariffs on Asian countries.

As of the last close, Levi shares have lost 2.8% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)