Advertisement|Remove ads.

Lightspeed Commerce Stock Plunges Despite Q3 Beat But Retail’s Impressed With Buyback Plan

Lightspeed Commerce, Inc. (LSPD) shares plummeted in early trading on Thursday after the Montreal-based e-commerce platform announced the results of its previously announced strategic review and its financial results for the fiscal year 2025 third quarter.

The company said its board, a committee of independent directors and executive leadership have unanimously determined that executing a full transformation plan as a public company will help maximize company and shareholder value.

The transformation plan will focus on go-to-market strategy, investments in key growth areas, initiatives to free up capital and a share repurchase program to return up to $400 million in cash to shareholders.

The company plans to immediately buy back $100 million under its current authorization.

Dax Dasilva, founder and CEO, said, “We've continued to grow the company since announcing the strategic review, having launched several new key initiatives that have already made a significant impact on our results.”

The executive said the company will provide more details on the transformation plans at its Capital Markets Day scheduled for March 26.

Lightspeed Commerce also reported third-quarter adjusted earnings per share (EPS) of $0.12 compared to $0.08 a year ago. Revenue climbed 17% year over year (YoY) to $280.1 million. The results exceeded the consensus estimates.

Adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) improved to $16.6 million from $3.6 million.

Citing strong revenue growth and adjusted EBITDA performance, the company said it expects to exceed its fiscal year 2025 guidance. The company flagged a stronger U.S. dollar and the meaningful reduction of go-to-market positions due to the restructuring as potential headwinds.

However, the company expects to invest the savings from the restructuring in growth markets and generate positive returns in the next fiscal year.

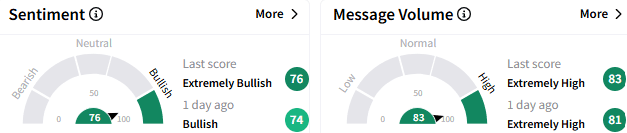

On Stocktwits, retail sentiment toward Lightspeed Commerce stock improved to ‘extremely bullish’ (76/100) from the ‘bullish’ mood that prevailed a day ago, and the message volume stayed at ‘extremely high’ levels.

Most platform users were left bewildered by the adverse stock reaction despite the share repurchase authorization.

The stock slumped 15.38% to $12.27 in early trading, marking a nearly five-month low. It has lost about 5% so far this year

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2239275331_jpg_81be89c46a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2166957713_jpg_a9ada70a7b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227231024_jpg_227a7ced1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Bury_resized_jpg_14e6fc7c2b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trade_Desk_jpg_e7ed8e2266.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ionq_resized_jpg_35563ea1fb.webp)