Advertisement|Remove ads.

Lincoln Electric Stock Gains After Q4 Earnings Beat: Retail Stays Extremely Bullish

Lincoln Electric Holdings (LECO) stock gained 11.5% on Thursday after the company’s fourth-quarter earnings topped Wall Street’s estimates.

The Cleveland, Ohio-based company reported fourth-quarter adjusted earnings of $146 million, or $2.57 per share, compared with the average analysts’ estimate of $1.99 per share, according to Koyfin data.

The welding equipment maker’s fourth-quarter revenue of $1.02 billion topped a Street estimate of $996 million.

However, its fourth-quarter organic sales declined 7.5%, hurt by lower industrial production activity & reduced capital spending.

The company that all product areas, consisting of consumables, equipment, and automation, declined during the quarter.

According to the Institute for Supply Management (ISM), the Purchasing Managers Index (PMI) remained below 50 for nine consecutive months till December. A PMI below 50 denotes economic contraction.

Lincoln Electric’s Americas welding segment was flat compared to last year, while international segment sales declined by 16%. The company said volume decline in the Americas was offset by new acquisitions.

Its Harris Products segment net sales rose 11.3%, aided by higher heating, ventilation, and air conditioning demand.

Lincoln Electric forecast 2025 organic sales to remain flat, excluding any impact from tariffs.

It also estimates capital expenditure between $100 and $120 million in 2025.

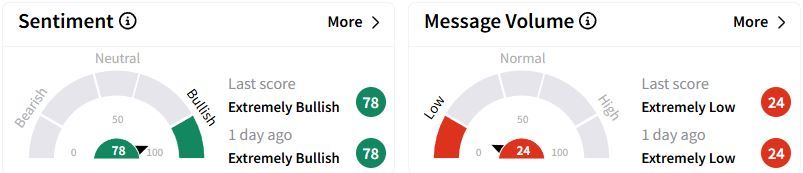

Retail sentiment on Stocktwits remained in the ‘extremely bullish’ (78/100) territory, while retail chatter was ‘extremely low.’

Over the past year, Lincoln Electric's stock has fallen 4.7%.

Also See: PBF Energy Stock Tumbles After Wider-Than-Expected Q4 Loss: Retail Optimism Unfazed

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1163170868_jpg_3975bd8be2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247687123_1_jpg_5a8fc404b7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_coinbase_new_jul_2eaf8eb2ac.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)