Advertisement|Remove ads.

PBF Energy Stock Tumbles After Wider-Than-Expected Q4 Loss: Retail Optimism Unfazed

PBF Energy stock was down 10% on Thursday, hitting its lowest level in nearly three years earlier in the session after the refiner reported a wider-than-expected fourth-quarter loss.

Excluding special items, the company reported a net loss of $2.82 per share, compared with the average analysts’ estimate of a loss of $2.78 per share, according to Koyfin data.

Its quarterly revenue fell to $7.35 billion from $9.14 billion in the year-ago quarter. Wall Street was expecting the company to post $7.42 billion in revenue.

The refiner lost $3.89 per barrel of throughput in terms of its fourth-quarter gross refining margin compared with $1.04 per barrel in earnings last year.

Refining margins have slumped globally due to lukewarm fuel demand in several major economies and a rise in global refining capacity.

PBF, which operates six refineries in the U.S., said it processed about 862,200 barrels of crude oil during the fourth quarter, compared with 878,200 barrels in the year-ago quarter.

The company also said the Feb. 1 fire at its refinery in Martinez, California, broke out when workers were preparing for planned maintenance. The refinery has a processing capacity of 157,000 barrels per day.

PBF said that the cost of repairs and the length of the shutdown from the incident

cannot be reasonably estimated currently.

The New Jersey-based company expects to process between 920,000 and 980,000 barrels of crude oil daily in 2025.

The company expects refining operating expenses between $2.4 billion and $2.6 billion in 2025.

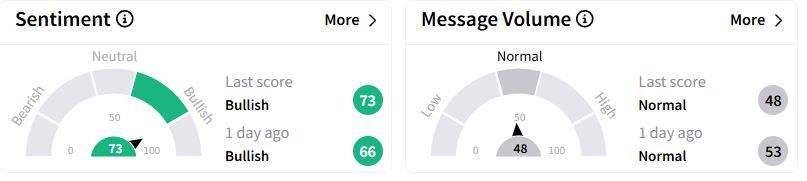

However, retail sentiment on Stocktwits moved higher in the ‘bullish’ (73/100) territory than a day ago, while retail chatter was ‘normal.’

One user said he would not sell PBF shares if Mexican billionaire Carlos Slim kept buying the stock. Slim had boosted his stake to 25% in the refiner in 2024.

Larger peers Marathon Petroleum, Phillips 66, and Valero Energy had all topped fourth-quarter earnings estimates earlier.

Over the past year, PBF stock has fallen 54.3%.

Also See: Chevron Stock In Spotlight As Oil Major Plans To Lay Off Up To 20% Workforce: Retail’s Bearish

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1813801150_jpg_9e452258fa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2190302521_jpg_796f64970e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194612888_1_jpg_5f7b7f6186.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1384896168_jpg_87fab3f04d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)