Advertisement|Remove ads.

Lithium Americas Stock Surges On $250M Investment From Orion Resources: Retail Sentiment Soars

Shares of Lithium Americas Corp. (LAC) surged more than 7% in Thursday’s regular trade after the company announced that it had received a strategic investment.

Orion Resources will invest $250 million in aggregate to fund the first phase of Lithium Americas’ Thacker Pass project. Orion will initially purchase senior unsecured convertible notes worth $195 million.

The investment firm will also pay Lithium Americas $25 million in exchange for payments related to minerals processed at Thacker Pass.

Subject to certain conditions being fulfilled, Orion has also committed to buying an additional $30 million worth of notes within two years of being requested by Lithium Americas.

The Vancouver-headquartered company announced that the investment is expected to close in the Mar. 10 week. It also revealed that Orion has agreed to evaluate an investment of $500 million in the second phase of Thacker Pass.

“Orion’s long-term investing horizon and experience with resource development makes them an excellent partner for Lithium Americas and Thacker Pass and contributes to our strong relationships with General Motors and the U.S. Department of Energy,” said Jonathan Evans, Lithium Americas’ President and CEO.

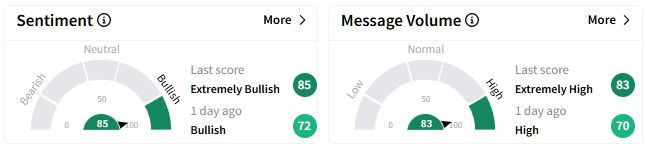

Reacting to the news, retail sentiment on Stocktwits around the Lithium Americas stock soared, entering the ‘extremely bullish’ (85/100) territory.

Message volume saw a similar surge.

One user posted a technical analysis of the stock, saying it could gain 5% by the end of the week.

Lithium Americas' stock has witnessed a see-saw momentum recently, declining 0.3% year-to-date. However, over the past year, the stock is down more than 43%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_snap_resized_jpg_9672f61595.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kalshi_logo_jpg_d4ea268948.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1249125319_jpg_31d1207b8e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)