Advertisement|Remove ads.

Bitcoin Tumbles As Trump's BTC Reserve Plan Fails To Impress: Retail Traders Livid As Strategy Stock, Other Cryptos Also Sink

Bitcoin (BTC.X) tumbled nearly 5% on Thursday evening as President Donald Trump signed an executive order to create a strategic Bitcoin reserve. The fall in Bitcoin prices also sank the Strategy Inc. (MSTR) stock, formerly known as MicroStrategy.

MicroStrategy chairman Michael Saylor had previously suggested that the U.S. government could buy up to one million BTC to set up the strategic reserve. The news comes a day ahead of the highly anticipated White House Crypto Summit.

However, Trump’s crypto and AI czar David Sacks revealed that the reserve would be created using Bitcoin that the U.S. government forfeited through legal actions and not from taxpayer money as expected earlier.

“The government will not acquire additional assets for the Stockpile beyond those obtained through forfeiture proceedings,” he said in a post on X.

Additionally, Trump’s executive order also mandates an audit of the government’s digital asset holdings – Sacks noted that while estimates peg the U.S. government’s BTC holdings at 200,000, it has not been verified so far.

“The U.S. will not sell any bitcoin deposited into the Reserve. It will be kept as a store of value. The Reserve is like a digital Fort Knox for the cryptocurrency often called ‘digital gold’,” Sacks added.

Reacting to the news, Bitcoin and other major cryptocurrencies like Ethereum (ETH.X), XRP (XRP.X), and Dogecoin (DOGE.X) tumbled, with BTC witnessing the steepest fall.

Shares of Strategy also fell nearly 8% in after-market trade as investors digested the impact of the government not buying the one million BTC that Saylor had expected.

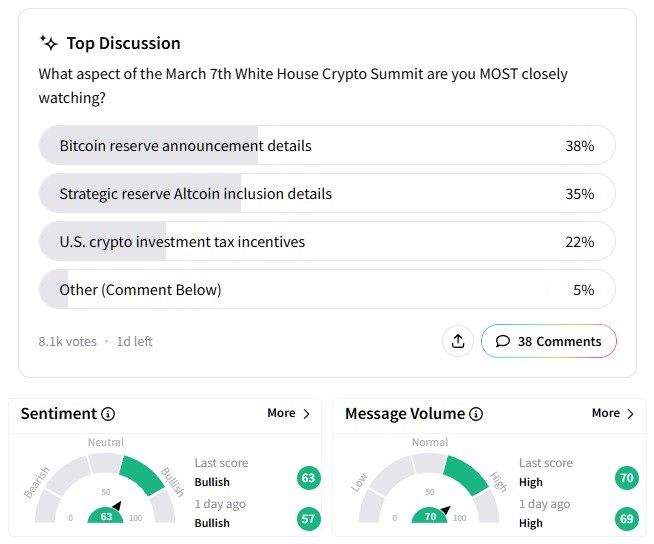

Although retail sentiment on Stocktwits around Bitcoin was in the ‘bullish’ territory, investors expressed anguish after finer details of the strategic reserve were revealed.

One user thinks that while this doesn’t mean Bitcoin is dead, the order has applied brakes on the current rally.

Another user asked people about the government investing billions of dollars in BTC.

Responding to the executive order, Saylor said he has “a few budget-neutral strategies” to acquire additional Bitcoin to help the government shore up its reserves.

Despite multiple recent upsurges, Bitcoin is down more than 6% year-to-date.

Strategy’s stock, on the other hand, managed to edge up, gaining over 1% during this period.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_anthropic_OG_jpg_51bd14bc5d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2233516954_jpg_72241a7246.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_tanker_resized_jpg_bb40d4bd7e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robinhood_CEO_OG_jpg_e773f9395c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_543225021_jpg_d5737b0d33.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Getty_Images_2173218234_fotor_2025021091559_3d9884379a.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)