Advertisement|Remove ads.

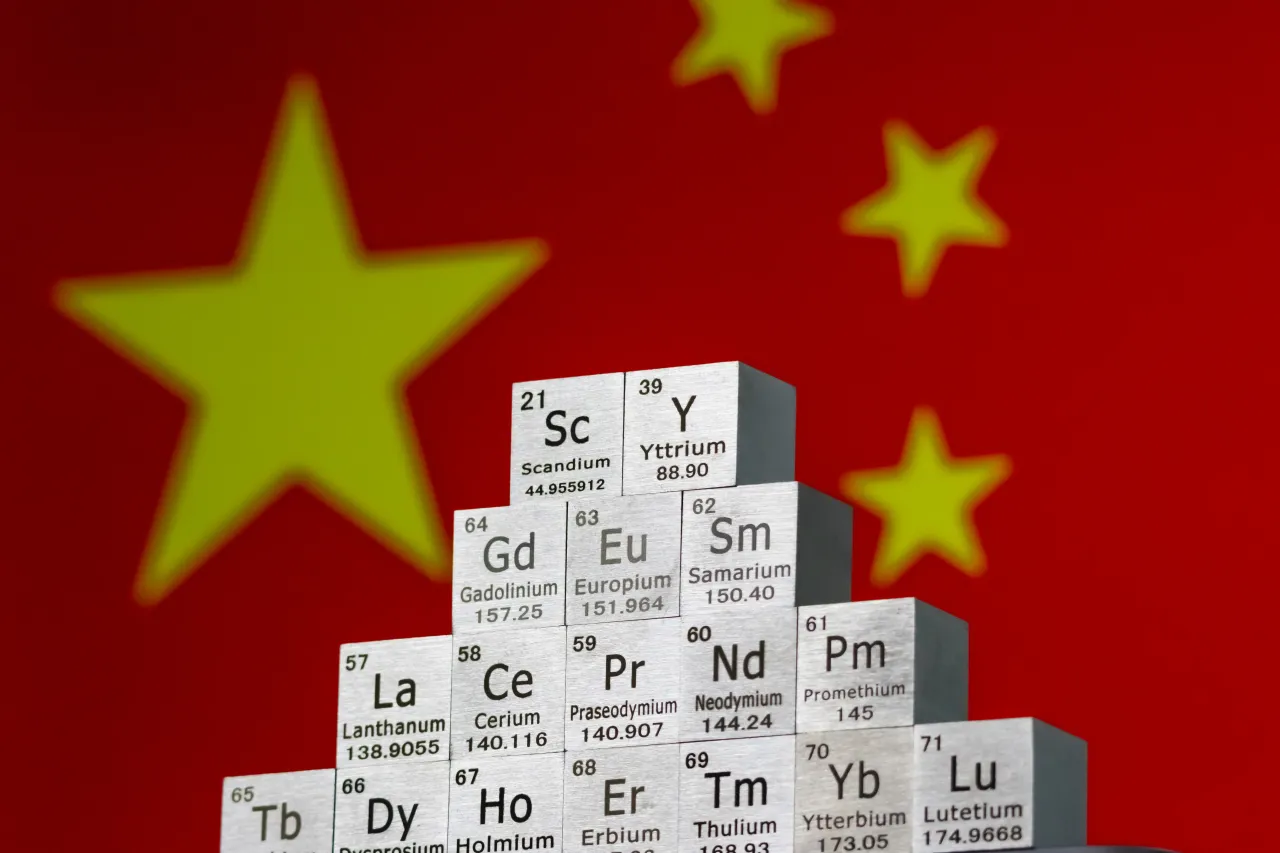

TMQ, CRML, USAR: Lithium, Rare Earth Stocks Rally Premarket As US-China Trade Dispute Heats Up

Critical minerals stocks surged in early premarket trading on Monday, as renewed trade tensions between the U.S. and China put the spotlight back on miners.

Lithium miners Albemarle and Lithium Americas advanced 6.7% and 4.3%, respectively, at the time of writing, while the biggest U.S. producer of rare earth minerals, MP Materials, rose 8.2%. Among other companies, Trilogy Metals gained 11.3%, Critical Metals stock jumped 18% and USA Rare Earth shares jumped 22.5%.

Retail sentiment on Stocktwits about Trilogy, Critical Metals, and USA Rare Earth was in the ‘extremely bullish’ territory at the time of writing.

“[The] U.S. government taking a stake is going to blow this out [of] the water with this size float,” one Stocktwits user said about USAR stock.

U.S. President Donald Trump said that the U.S. would impose 100% tariffs on China in response to Beijing’s rare earth export curbs. The White House has stepped up its efforts over the recent months to step up domestic production of critical minerals and has taken up stakes in companies such as Lithium Americas, MP Materials, Critical Metals and Trilogy Metals.

Separately, the Financial Times reported that the U.S. is looking to buy as much as $1 billion of critical minerals to stockpile. The newspaper, citing public filings published in recent months by the Pentagon’s Defense Logistics Agency, said that planned purchases include as much as $500 million of cobalt, up to $245 million of antimony, and $100 million of tantalum.

On Sunday, China defended its decision to ban exports of critical rare earth technology, stating that it was made to maintain global peace. Rare earths are a critical component of several weapons systems.

However, Beijing said that it was willing to discuss rare earth and other concerns with the U.S., and Trump said people need “not worry” about the dispute with China.

Also See: Gold Races To New Record As Safe-Haven Rush Builds – Next Stop Could Be $4,500

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_changpeng_zhao_binance_CEO_OG_jpg_1f2a158765.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_iran_natanz_nuclear_facility_jpg_ca08028936.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2234618957_jpg_1c670c00ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246580703_jpg_9700e1e7e8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_cryptocurrency_generic_jpg_4184e1dbd8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_charles_hoskinson_OG_jpg_7eaff6116d.webp)