Advertisement|Remove ads.

Eli Lilly Stock Faces Worst Day In Nearly 4 Years On Q4 Weight-Loss Drug Sales Miss, But Retail Bullish On 2025 Projections

Shares of Eli Lilly & Co. dropped over 7% on Tuesday morning, reaching levels last seen in late November and marking the stock’s worst day since March 15, 2021.

The decline followed a disappointing fourth-quarter revenue outlook update, particularly from its blockbuster weight-loss and diabetes drugs, Mounjaro and Zepbound.

The company now forecasts full-year revenue of about $45 billion, down from its previous range of $45.4 billion-$46 billion and below the consensus of $45.55 billion.

Fourth-quarter revenue is expected to be approximately $13.5 billion, falling short of the $13.93 billion consensus.

Sales of Mounjaro totaled $3.5 billion, below the $4.4 billion estimate, while Zepbound brought in $1.9 billion, missing expectations of $2.14 billion.

CEO David A. Ricks attributed the shortfall to slower-than-expected growth in the U.S. incretin market, compounded by lower year-end channel inventory. Incretins like GLP-1 are used in diabetes and obesity drugs such as Mounjaro and Zepbound.

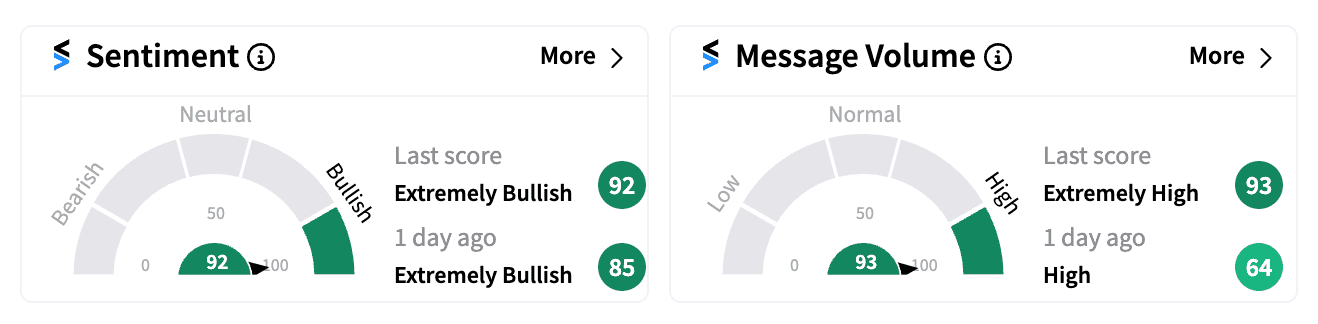

However, retail sentiment on Stocktwits stayed ‘extremely bullish,’ with the ticker climbing to the top five trending symbols list amid a spike in message volume.

Many retail investors considered the dip an overreaction, expressing optimism for 2025 projections and hinting they were buying the dip.

Lilly expects continued growth for Mounjaro and Zepbound in 2025, supported by expanded manufacturing capacity and new market launches.

The company plans to increase production of tirzepatide by at least 60% in the first half of 2025 compared to the same period in 2024.

Lilly anticipates revenue contributions from new drugs, including oncology treatment Jaypirca, dermatitis medication Ebglyss, Crohn’s disease therapy Omvoh, and Alzheimer’s drug Kisunla.

Additionally, the company is pursuing approvals for new indications of existing medicines and potential launches, such as imlunestrant for metastatic breast cancer.

Lilly expects its experimental weight-loss pill, orforglipron, to receive approval as early as next year, CEO David Ricks revealed during an interview with Bloomberg TV at the JPMorgan Healthcare Conference in San Francisco on Monday. Data on the pill is expected by mid-2025.

Lilly’s stock has gained over 16% in the past year but is down nearly 5% in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1384896168_jpg_87fab3f04d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263454468_jpg_23f4595a31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)