Advertisement|Remove ads.

Lobo EV Stock Notches Best Day Ever, Retail Interest Soars As Investors Eye 2025 Growth Potential

Lobo EV Technologies Ltd. (LOBO) shares soared nearly 62% on Tuesday to a two-month high, marking their best session on record. The rally extended after hours, with the stock gaining over 8% as retail interest surged, driven by a bullish full-year forecast.

The Tianjin, China-based electric vehicle maker released its fiscal 2025 guidance last week, projecting revenue of $28 million to $30 million, a 41.5% jump from last year.

The company also expects to report a record net income of approximately $3 million, driven by stronger sales of e-bikes and tricycles and improved operational efficiency.

“We are scaling responsibly while seizing opportunities in high-potential markets,” said CEO Huajian Xu. He pointed to Lobo’s deep discount relative to fundamentals, noting a valuation of just 1x earnings and 0.2x sales.

Lobo highlighted the growing demand for affordable two and three-wheeled EVs globally, particularly in Latin America, where they have gained traction following success in Eastern Europe.

Other drivers include enhanced production efficiency, upgraded IT infrastructure, and a ramp-up in high-margin product lines such as recreational four-wheelers and intelligent mobility systems.

At the 2025 Canton Fair, the company’s 160 km/h electric motorcycle received strong market feedback.

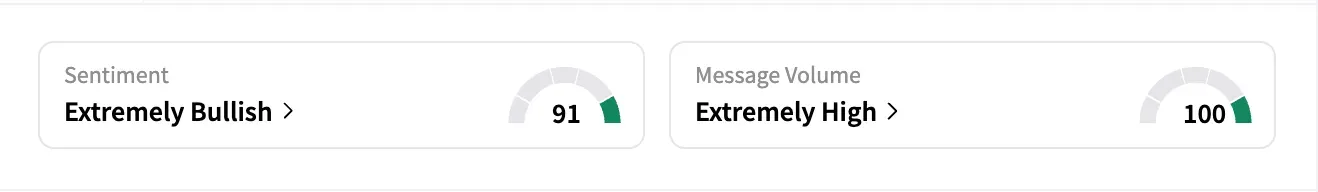

Stocktwits following for LOBO surged 28% over the past week — the biggest jump among all auto stocks tracked — reflecting rising retail enthusiasm.

The company has a market cap of over $10 million, or just 0.001% of Tesla’s trillion-dollar valuation.

“$LOBO will kiss $10+ in one session,” said one bullish Stocktwits user.

Another chimed in: “This stock should be $550 per share easy based on solid fundamental analysis.”

In April, Lobo reported full-year 2024 revenue of $21.2 million, up from $15.5 million in FY23, as it expanded its global footprint.

Despite short-term profitability pressure from expansion and listing costs, Xu said the company remains focused on long-term value creation, including penetration into Latin America, Africa, and Central Asia.

Lobo also announced plans to launch AI-powered EVs, strengthen regulatory compliance, and invest further in R&D while exploring localized factory setups in key international markets.

Still, Lobo’s stock remains down nearly 33% year to date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1813801150_jpg_9e452258fa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2190302521_jpg_796f64970e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194612888_1_jpg_5f7b7f6186.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1384896168_jpg_87fab3f04d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)