Advertisement|Remove ads.

Lockheed Martin, RTX Face Retail Skepticism As Earnings Loom: Here’s Why

Lockheed Martin Corp. (LMT) and RTX Corp. (RTX) are set to report their quarterly earnings on Tuesday, but retail investors on Stocktwits have turned bearish heading into the report as supply issues and backlogs remain a concern for these defense-oriented companies.

The S&P 500 Index (SPX), which includes Lockheed Martin and RTX, closed flat on Friday after hitting a record high the previous day, driven by decent results from companies such as PepsiCo and Taiwan Semiconductor, as well as strong market momentum.

Here’s a peek into what Lockheed Martin and RTX are expected to do when they report:

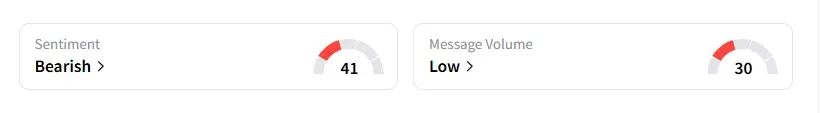

1. Lockheed Martin (LMT): Retail sentiment on the stock turned to ‘bearish’ from ‘neutral’ a day ago, with chatter at ‘low’ levels, according to Stocktwits data.

Lockheed Martin’s shares were marginally up in premarket trading on Tuesday and down nearly 5% year-to-date.

The company is expected to post total revenue of $18.55 billion, a 9% rise year-over-year, and earnings per share are estimated to be $6.47, according to data from Fiscal AI.

TD Cowen, in a note in early July, downgraded Lockheed Martin to ‘Hold’ from ‘Buy’ and also cut the price target to $480, down from $500, citing the shares could remain range-bound over the next year, given the F-35 and execution challenges.

The "plethora of F-35 overhangs may not clear this year," TD Cown stated, according to TheFly.

The company has acknowledged that the F-35 program has experienced delays due to the deployment of a key technology upgrade aimed at enhancing the jet’s cockpit displays and increasing the processing power of its advanced electronic systems.

2. RTX Corp. (RTX): Retail sentiment on the stock has remained unchanged and in the ‘bearish’ territory with chatter levels at ‘low,’ according to Stocktwits data.

RTX’s shares were up nearly 1% in premarket trading and have surged over 30% year-to-date.

The company’s total revenue in the second quarter is expected to rise 7% to $20.62 billion, and earnings per share are expected to be $1.43, according to data from Fiscal AI.

Near-term growth for RTX is constrained by operations, not demand, Bernstein analysts noted in early July, according to TheFly.

RTX is experiencing supply chain snags that have led to backlogs. In April, executives stated that some of this is driven by contractual terms and the length of those contracts, while others are attributed to numerous programs involving long lead-time materials that naturally extend timelines.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250240969_jpg_dd9be8c5ea.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_iran_jpg_753ef9f5af.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_BX_resized_blackstone_jpg_1a169d1a1c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_michael_saylor_strategy_2013_resized_jpg_e358c15fd4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231786698_jpg_4d7b65921f.webp)