Advertisement|Remove ads.

LRCX Stock Surges Over 5% On Upbeat Q2, Lands 'Buy' Rating From Analyst

- Lam reported second-quarter revenue and profit above expectations; its quarterly forecasts also came in above targets.

- Wafer equipment giant and Lam competitor, ASML, reported blowout earnings on Tuesday.

- Stocktwits sentiment for Lam shifted to ‘extremely bullish’ from ‘bullish.’

Lam Research Corp. shares rose 5.5% in after-market trading on Wednesday, boosted by its second-quarter earnings and quarterly forecasts, which came in above expectations.

Alongside blowout results from larger rival ASML, Lam’s report reinforces that AI development and the investment wave around it remain firmly in full throttle.

Strong Report, Forecast

Lam forecast third-quarter revenue of $5.7 billion, plus or minus $300 million, compared with estimates of $5.34 billion from LSEG/Reuters. Its $1.35 per share adjusted profit forecast was also higher than the $1.20 per share estimate.

In Q2, Lam’s revenue rose 22% to $21.9 billion. Systems revenue, which primarily includes sales of the company’s chipmanufacturing equipment, rose to 28% to $3.4 billion. Customer support-related revenue rose 14% to $1.9 billion.

"Lam delivered another strong quarter to cap a record year," said CEO Tim Archer in a statement.

"Entering 2026, our expanding product and services portfolio is enabling the market's transition to smaller, more complex three-dimensional devices and packages. With AI accelerating, we are ramping execution velocity across the company to support our customers' growth."

Sector-Wide Strength

On Tuesday, ASML – which counts top chipmakers like TSMC and Nvidia among its customers – disclosed an order book of 13.16 billion euros ($15.9 billion) in the last quarter. The figure came in nearly double the analysts’ 6.95 billion euros estimate, sparking a fresh wave of optimism across the chip sector.

To be sure, while they operate in the same sector, ASML specializes in lithography machines, and Lam focuses on wafer fabrication equipment such as etching and deposition systems.

Investor Reaction

Summit Insights upgraded its rating on LRCX stock to ‘Buy’ from ‘Hold,’ following the company’s report. Lam is poised to capture a "disproportionate share" in the upcoming technology transition in DRAM, logic, and NAND, and the stock’s risk-reward remains "favorable" despite its recent price run-up, the research firm said in its investor note.

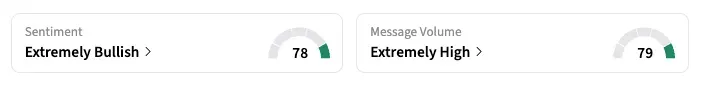

On Stocktwits, retail sentiment for LRCX shifted to ‘extremely bullish’ from ‘bullish’ the previous day, amid ‘extremely high’ message volume.

LRCX stock more than doubled last year as the company benefited from the AI boom, with investors backing its long-term growth as a critical supplier to the high-value semiconductor industry.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Why Did IBM Stock Surge Over 7% In After-Hours Trading Today?

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_crash_490d43331a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_88435a6487.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_dominos_resized_jpg_f70082df7e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1198350622_jpg_c4fc77e19d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_merck_logo_resized_05f46cfc54.jpg)