Advertisement|Remove ads.

Lucid Stock Slips Premarket As Gravity Stumbles in A Make-Or-Break Quarter With Software Woes

- Gravity owners' feedback highlighted ongoing system glitches even after Lucid rolled out its latest software update.

- The company has positioned Gravity as the main driver of near-term production and sales.

- The SUV’s rollout has faced earlier pauses and supply constraints.

Shares of Lucid Group Inc. (LCID) slipped in premarket trading as renewed customer complaints around its Gravity SUV surfaced online, adding pressure at a time when the model is central to the company’s near-term execution and growth plans.

The company’s shares hit a new all-time low on Tuesday, underscoring investor caution.

Gravity Software Woes Resurface

The renewed scrutiny follows fresh owner complaints that circulated on X and Reddit in recent days, with Gravity drivers reporting ongoing software problems despite Lucid’s 3.3.20 update earlier this month. Issues cited included key fob recognition failures, navigation errors, false safety alerts, and inconsistent system responses, according to a report by news outlet EV.

The complaints supposedly surfaced even after interim CEO Marc Winterhoff acknowledged in an email to customers that the company had fallen short on software quality.

While Lucid said the update improved areas such as startup performance, navigation, camera stability, and climate control, some owners described persistent problems during extended drives and immediately after service visits.

Gravity’s Importance To Near-Term Results

The renewed backlash comes at a sensitive time for Lucid. In December, CFO Taoufiq Boussaid said the fourth quarter would be “primarily a Gravity quarter,” with the SUV expected to account for the majority of production and sales. Lucid delivered 3,099 vehicles in the same quarter last year.

Gravity, Lucid’s second vehicle after the Air sedan, began initial deliveries in December 2024 and is offered in Touring and Grand Touring variants starting at $79,900 and $94,900, respectively. European deliveries are set to begin within weeks as the company looks to gain traction in the region.

Gravity’s Bumpy Start

Gravity’s rollout has been uneven, marked by earlier delivery pauses, supply chain constraints, and now recurring software complaints. Lucid trimmed its full-year production outlook to about 18,000 vehicles in November amid weaker EV demand and operational challenges.

Meanwhile, Lucid has highlighted longer-term growth drivers such as its robotaxi partnership with Uber and a planned mid-size vehicle platform priced around $50,000.

How Did Stocktwits Users React?

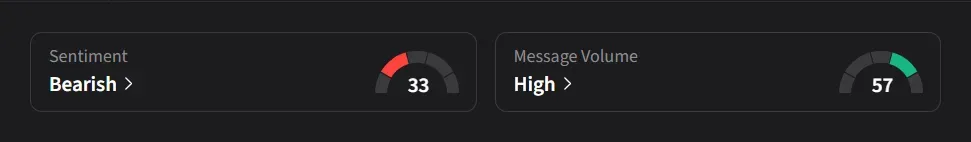

On Stocktwits, retail sentiment was ‘bearish’ amid ‘high’ message volume.

One user said the complaints were “very bad for short term. At these level of complaints the stock will plunge to $5”

Another user said the interim CEO was not adequately qualified for the position, adding that the board appeared slow to recognize the issue.

Lucid’s stock has declined 64% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228080229_jpg_dba4a8dbc2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_arthur_hayes_OG_jpg_734ff95af6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Webull_stock_resized_jpg_48b42f4c8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247874160_jpg_4fb51355e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)