Advertisement. Remove ads.

Lululemon Keeps Retail Investors On Edge Ahead Of Q2 Earnings: What’s Wall Street Expecting?

Lululemon Athletica Inc. (LULU) shares are recovering in pre-market trading after closing over 4% lower on Wednesday.

The drop followed mixed signals from retail peers Abercrombie & Fitch (ANF) and Foot Locker (FL), which reported strong earnings but raised concerns about an increasingly uncertain economic climate and announced store closures, respectively.

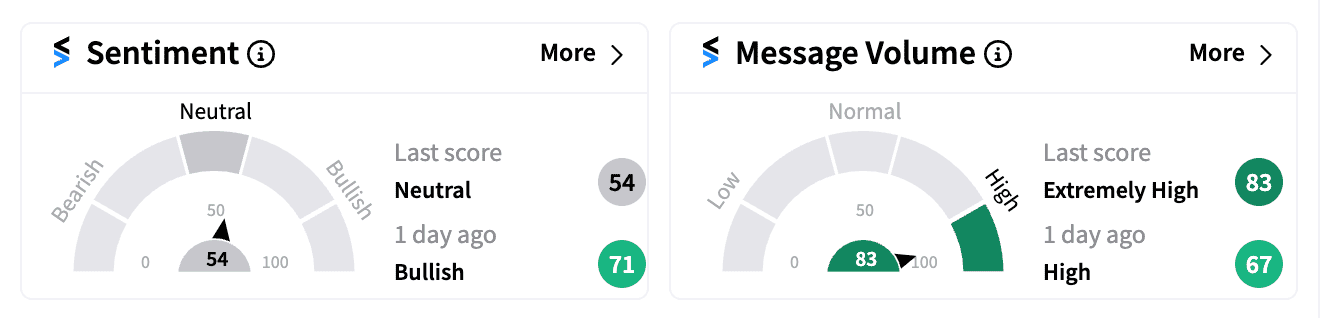

On Stocktwits, sentiment among LULU’s 38,000 watchers dropped to ‘neutral’ (54/100) from ‘bullish’ levels just a day earlier. Message volume turned ‘extremely high’ (83/100), signaling intense interest ahead of the company’s Q2 earnings release after market hours on Thursday.

Bearish sentiment dominated many discussions. One user warned of a possible recession impacting guidance, while another predicted a 20% drop in Lululemon’s stock price, citing tightening consumer budgets and rising theft concerns.

However, others remained optimistic, suggesting that any recent dip was a “market manipulation trick” and that just meeting expectations could keep shares above $275.

Analysts forecast Lululemon will report a 9% increase in revenue to $2.41 billion for the quarter, up from $2.21 billion a year ago. Net income is expected to rise by nearly 8% to $368.52 million, with estimated earnings per share (EPS) of $2.93.

Wedbush on Wednesday lowered its price target for Lululemon to $324 from $400 while keeping an ‘Outperform’ rating, citing recent unexpected turbulence, including last month’s product quality issues with the “Breeze Through” leggings line. The brokerage firm expects downward-revised guidance due to these setbacks.

Jefferies remains bearish with an ‘Underperform’ rating and a $220 price target, pointing to ongoing issues from recent store visits and softer sales trends in Q2, along with rising competition and execution errors.

TD Cowen has also trimmed its target to $375 from $420 but maintains a ‘Buy’ rating. The firm believes Lululemon still holds a strong market position and has multiple levers to drive growth, though challenges like improving store experience and product quality remain.

Lululemon’s position as a leader in high-end athleisure is also reportedly being challenged by cheaper alternatives, or “dupes,” gaining popularity on platforms like TikTok.

With shares down over 48% this year, Lululemon’s Q2 earnings report could be a pivotal moment. Investors will be looking for clarity on how the company plans to navigate an increasingly competitive market and whether it can regain its footing amid rising economic uncertainty.

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_price_rising_OG_jpg_5f141f956f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Apple_i_Phone_17_jpg_f5d6f375c2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_apple_iphone_17_jpg_81dde6287d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/08/2016-02-24t120000z-341190126-gf10000320991-rtrmadp-3-thailand-business-2025-08-30fd086ee671eeb1054eae7ad98cc01e.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_obesity_resized_jpg_cbb4f6b5e4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_jpg_9c9db98ee3.webp)