Advertisement|Remove ads.

Eli Lilly, Novo Nordisk’s Weight-Loss Drugs Deemed Cost-Effective By Pricing Watchdog: BofA Deems Decision A ‘Win’

The Institute for Clinical and Economic Review (ICER) determined on Tuesday that Novo Nordisk (NVO) and Eli Lilly and Co.’s (LLY) weight loss drugs are cost-effective, a judgment that is a “win” for the two companies, according to Bank of America.

The ICER released a draft report assessing the comparative clinical effectiveness and value of Novo’s Semaglutide and Lilly’s Tirzepatide weight loss drugs for obesity management on Tuesday and judged oral Semaglutide, injectable Semaglutide, and injectable Tirzepatide as cost-effective. The firm estimated net prices of $6,830 for Semaglutide and $7,973 for Tirzepatide.

On Stocktwits, retail sentiment around LLY stock stayed within ‘bearish’ territory over the past 24 hours while message volume rose from ‘extremely low’ to ‘low’ levels.

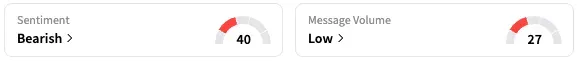

Meanwhile, sentiment on NVO stock stayed in ‘bearish’ territory, coupled with ‘low’ message volume.

ICER, however, flagged certain affordability concerns. ‘We estimate that fewer than 1% of eligible patients could be treated at current and assumed net prices….This raises serious concerns about affordability,” it said.

The firm also noted that it has evidence demonstrating greater weight loss with Lilly’s Tirzepatide than Novo’s Semaglutide. However, in the absence of more details regarding the cardiovascular effects of the two drugs, it considers treatment with Tirzepatide compared with Semaglutide to be “promising but inconclusive.”

The firm also noted that oral Semaglutide resulted in slightly lower amounts of weight loss compared to injectable Semaglutide, but provided the uncertainty regarding cardiovascular benefits, judged oral Semaglutide to be “comparable or worse” than injectable Semaglutide.

ICER will hold a public meeting on the draft report on November 13, after which it will issue a final report. The findings within the firm’s draft report should not be interpreted as its conclusions, the firm said.

BofA views the analysis as "an important and necessary step" toward securing better coverage from employers and payers for GLP-1 category weight loss drugs, according to TheFly. The analyst kept a ‘Buy’ rating and $900 price target on Eli Lilly shares, representing an upside of nearly 22% from Lilly’s closing price on Monday.

While LLY stock is down by 3% this year, NVO stock is down 37%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_cybertruck_jpg_7f6ed70b80.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Workday_logo_resized_d2d5258f05.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Lucid_jpg_221b9d07ec.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222819201_jpg_edcbb1336e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)