Advertisement|Remove ads.

Hyperion DeFi Stock Jumps As Retail Traders Back CEO Shake-Up

Shares of Hyperion DeFi (HYPD) rose by more than 21% in afternoon trading on Tuesday as investors cheered the company’s leadership changes.

The management said that CEO Michael Rowe had notified them of his intent to resign. In the interim, Chief Investment Officer and board member Hyunsu Jung will step in as acting chief executive. He will be supported by the company’s newly appointed CFO, Happy Walters, who is also joining the board, as well as strategic advisor Max Fiege.

One retail trader forecast that Jung replacing Rowe should lead to a “strong month” for Hyperion’s stock.

Another retail trader argued the leadership change signaled a pivot toward the company’s treasury activities. The company announced in August its plan to pivot to a digital asset treasury (DAT) backed by Hyperliquid (HYPE) tokens, becoming the first publicly traded company to do so.

The user also forecast that the company may sell its non-core assets later this year and use those funds to buy more HYPE tokens. They said the shift could justify a valuation double the current level, with the stock potentially climbing above $20 next quarter if HYPE continues to gain momentum.

HYPE token’s price gained 4.2% in the last 24 hours despite weakness in the broader cryptocurrency market. Retail sentiment around the token moved higher within ‘bullish’ territory over the past day, with chatter increasing to ‘high’ from ‘normal’ levels.

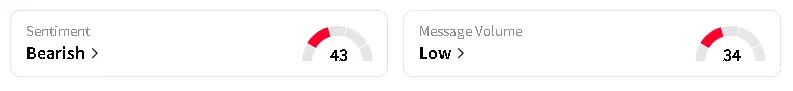

Meanwhile, the overall retail sentiment around Hyperion’s stock improved but remained in ‘bearish’ territory over the past day.

The stock has declined by more than 30% this year and has fallen by 80% over the past 12 months.

Read also: QMMM Soars Over 300% After Unveiling $100M Crypto Treasury Plan – Here Are The Tokens It’s Backing

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)