Advertisement|Remove ads.

Wall Street Punishes Lululemon With A Triple Downgrade: Retail Investors Agree

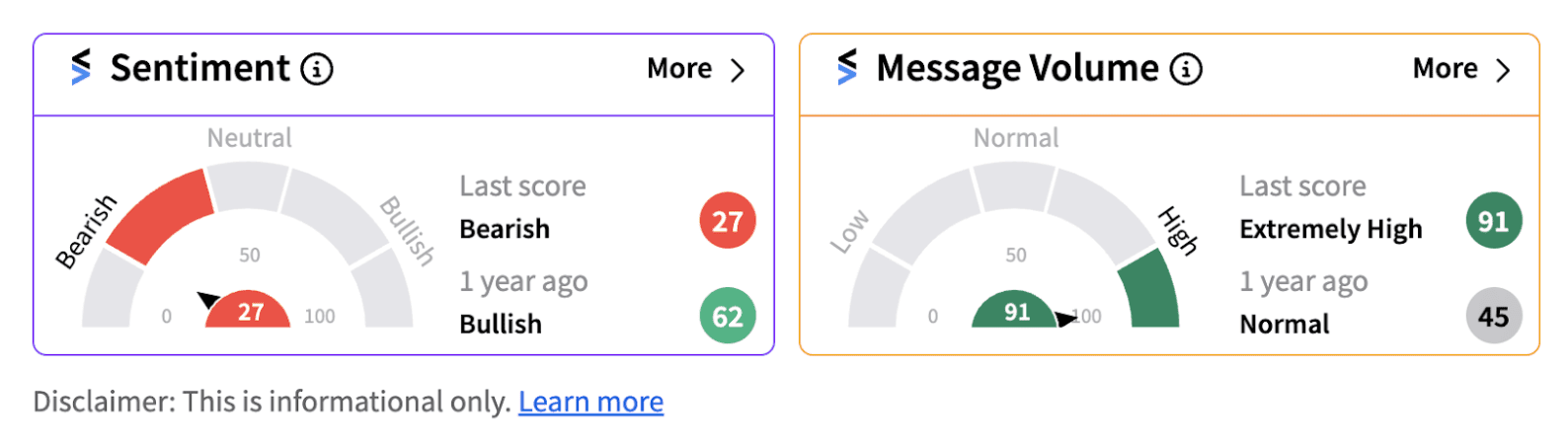

Shares of Lululemon Athletica Inc plunged over 9% on Thursday after the stock witnessed a triple downgrade from major Wall Street brokerages. Retail sentiment remained sour with the sentiment meter trending in bearish territory (27/100) supported by extremely high message volume. Thursday’s slide took the stock to its lowest level in four years.

Citi analysts reportedly downgraded the stock from ‘Buy’ to ‘Neutral’ while reducing the price target to $300 from $415. The analysts believe the firm’s lackluster product group has made it vulnerable to tough competition and promotional pressures in the coming times.

“Category weakness and a tougher macro backdrop make it unlikely LULU sees a reacceleration in US trends in 2H,” the analysts said according to a report.

According to a Bloomberg report, a Lululemon spokesperson said that the firm has hit the pause button on the sales of its Breezethrough yogawear to make the necessary adjustments to deliver the best possible product experience.

Following the report, JPMorgan reportedly removed the stock from its list of top stock picks. The firm also reduced its price target on the stock to $338 from $457 while maintaining an ‘Overweight’ rating. Meanwhile, TD Cowen also reportedly lowered its price target on the stock to $420 from $447. What is worth noting here is the fact that even the lowest price target — $300 by Citi — is significantly above Lululemon’s current price of about $251.

The stock has faced a steep decline of more than 50% of its value on a year-to-date (YTD) basis. Still, retail investors are viewing this less as a long-term discount to buy, but rather a value trap given the company’s challenging fundamentals.

One user named ‘Mamafox’ appeared convinced on the negative fundamentals stating that "no one is buying the dip” in this crash.

Photo Courtesy: Wikipedia

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_chart_jpg_3ff1b3a682.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228107699_jpg_f433126e50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227347233_jpg_00e33be418.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2239275331_jpg_81be89c46a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2166957713_jpg_a9ada70a7b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)