Advertisement|Remove ads.

Lyft Draws Investor Attention After Wedbush Downgrades Stock Amid Autonomous Vehicle Risks

- The analyst said the market may be underestimating the impact of autonomous vehicles on the company’s discounted cash flow.

- Risks also arise from Lyft's U.S. ridesharing market exposure and undiversified offering mix, he added.

- Earlier, Jefferies lowered its price target to $22 from $23 while keeping a ‘Hold’ rating, as per TheFly.

Wedbush Equity Research Analyst Scott Devitt downgraded Lyft Inc. (LYFT) to ‘Underperform’ from ‘Neutral’ and reduced its price target to $16 from $20, citing risks from the impact of autonomous vehicle disruption.

Devitt said that the firm believes the risk comes from Lyft's U.S. ridesharing market exposure and undiversified offering mix, according to TheFly. Wedbush believes the market is misreading the negative terminal value impact that autonomous vehicles may have on the company’s discounted cash flow value.

Autonomous Rides Push

In October, Lyft partnered with Tensor Auto to bring the California-based Robocars onto its platform in 2027. Individual owners can list Tensor’s vehicles on the platform in select markets once approved. The company has reserved hundreds of Robocars across Europe and North America. Lyft is also partnering with Alphabet’s Waymo to launch the latter’s fully autonomous ride-hailing service in Nashville in 2026.

Lyft’s push into autonomous vehicles comes as rival Uber Technologies (UBER) is amping up its own efforts to expand its global AV fleets. Recently, UBER announced that it will leverage NVIDIA’s AI Architecture to accelerate its robotaxi and autonomous fleet offerings. The ride-hailing company is already offering autonomous robotaxi rides with WeRide (WRD) in Riyadh, though it currently has a vehicle operator.

Earlier, Jefferies lowered Lyft’s to $22 from $23 while keeping a ‘Hold’ rating, as per TheFly.

How Did Stocktwits Users React?

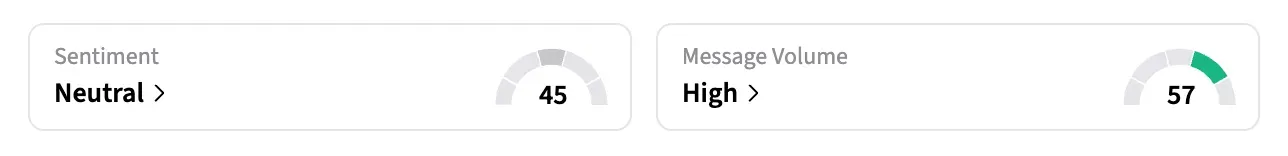

On Stocktwits, the retail sentiment around Lyft remained in the ‘neutral’ territory over the past 24 hours, and message volume stayed at ‘high’ levels at the time of writing.

LYFT was among the top trending tickers on Stocktwits at the time of writing.

Shares of LYFT are up over 46% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2248471134_jpg_9957fc576c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_patrick_soon_shiong_jpg_5f4d6bc18d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tandem_diabetes_resized_jpg_5f199c73c6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_82880353_jpg_0f9b1c5046.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228107699_jpg_f433126e50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_applovin_OG_jpg_12b141cd06.webp)