Advertisement|Remove ads.

Macy's Stock In Focus After Mixed Q4 Earnings: Retail Sentiment Lags

Shares of Macy's Inc. were in the spotlight on Thursday after the department store reported mixed fiscal fourth quarter earnings and gave a cautious outlook amid macroeconomic uncertainty, with retail sentiment staying cautious.

Macy’s net sales decreased 4.3% to $7.7 billion in the latest quarter, missing estimates. Earnings per share came in at $1.80, above Wall Street estimates of $1.54. It reported fourth quarter comparable sales were down 1.1% on an owned basis, with Bloomingdale’s posting owned comparable sales growth of 4.8%.

Macy's projected Q1 adjusted EPS at $0.12-$0.15, compared to the consensus of $0.29. It estimates Q1 revenue between $4.4 billion and $4.5 billion, compared to the consensus estimate of $4.49 billion.

“As we close out the first year of the Bold New Chapter strategy, investments in the customer experience enabled us to achieve our highest comparable sales of the year, our best performance in 11 quarters,” said Tony Spring, chairman and CEO of Macy’s.

“At Macy’s, our First 50 locations delivered four quarters of increased sales, while our luxury nameplates, Bloomingdale’s and Bluemercury, achieved accelerated annual sales growth."

Macy’s, which has been on a turnaround journey over the past several months, reportedly plans to take a “prudent” approach.

For fiscal 2025, Macy's expects adjusted EPS between $2.05 and $2.25, below the consensus estimate of $2.32. FY25 revenue is expected between $21 billion and $21.4 billion, compared to the consensus of $21.34 billion.

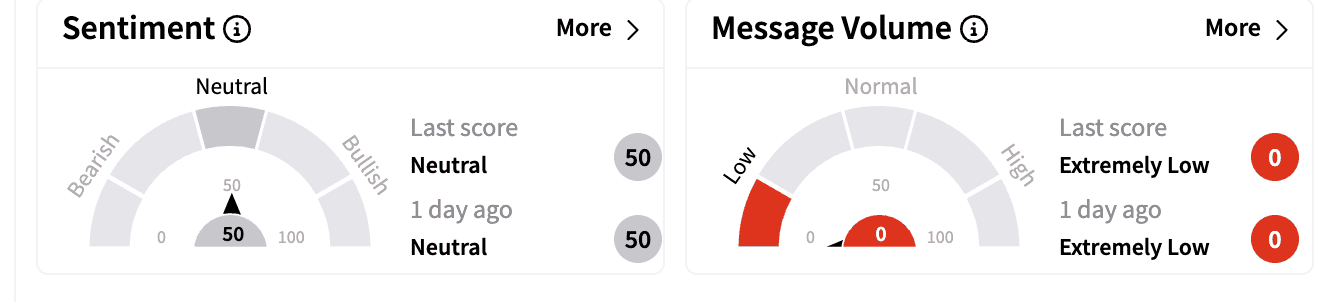

Sentiment on Stocktwits was subdued, remaining ‘neutral’ on Thursday. Message volume was in the ‘extremely low’ zone.

One commenter suggested shareholders should care more about Macy's fixing its stores than share buybacks.

Another hoped for a stock rebound around dividend time.

The department store also announced it plans to resume share buybacks under its remaining $1.4 billion share repurchase authorization.

Macy's stock is down 22% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262606802_1_jpg_86ff244e32.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215390052_jpg_84ddd1faac.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2177851484_jpg_b969f68c05.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2158238458_jpg_48ab7af27c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rocketlab_resized_jpg_92c1a02a7f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)