Advertisement|Remove ads.

Magnite Stock Surges On Expanding Amazon Advertising Partnership: Retail Turns Bullish

Sell-side ad platform Magnite Inc. (MGNI) shares traded 7% higher on Tuesday morning after the company expanded its partnership with Amazon Publisher Services (APS).

The enhanced collaboration combines APS' Transparent Ad Marketplace (TAM) and Magnite’s SpringServe ad server to simplify access to premium streaming TV demand on Amazon’s Fire TV ecosystem.

Content publishers now have simplified access to advertiser demand through Magnite, while Magnite benefits from expanded reach into Fire TV’s streaming ad inventory through APS.

By combining TAM with SpringServe, the integration simplifies how publishers engage with high-value programmatic buyers.

Advertisers, in turn, gain improved visibility on Amazon platforms like Fire TV, supporting broader and more targeted streaming ad efforts.

“We’re pleased to broaden our work with Amazon Ads to make more streaming content on Fire TV devices available to buyers through Magnite,” said Sean Buckley, President, Revenue at Magnite.

“By developing the custom integration, we’re able to more comprehensively connect advertisers to premium streaming inventory across Fire TV devices.”

The partnership between APS and Magnite dates back several years. Magnite joined forces with APS in 2016 as an early partner in the Transparent Ad Marketplace, helping generate demand for publishers.

More recently, it was among the initial participants in Amazon Ads’ Certified Supply Exchange Program, reinforcing their alignment within the digital advertising ecosystem.

With streaming viewership on the rise, the demand for efficient, premium advertising tools is intensifying.

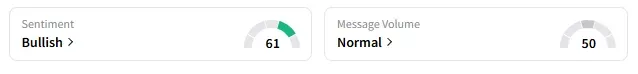

On Stocktwits, retail sentiment around Magnite changed to ‘bullish’ from ‘neutral’ the previous day.

A Stocktwits user called the company an upcoming monopoly.

Another user said the partnership will reap monetary gains.

Magnite stock has gained 1.8% in 2025 and 43.8% in the past 12 months.

Also See: D-Wave Shares Jump On Sixth-Gen Quantum Computer Launch: Retail Bull Says Hold The Stock

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)