Advertisement|Remove ads.

Marriott Lowers 2025 Room Revenue View Amid Softness, Pullback In US Officials' Stay

Marriott International (MAR) cut its full-year room revenue outlook and projected second-quarter earnings below expectations on Tuesday, reinforcing signs that travelers are pulling back on vacations and hotel stays amid ongoing economic uncertainty.

The hotel industry is also feeling the impact of reduced federal spending, leading to fewer bookings from government entities.

Marriott, which also operates hotels such as Sheraton, Courtyard, and Ritz-Carlton, reported a 10% decline in room nights booked by U.S. government agencies.

Marriott now expects 2025 room revenue to grow between 1.5% and 3.5%, down from its previous forecast of 2% to 4%.

It also projected second-quarter adjusted earnings of $2.57 to $2.62 per share, below the $2.68 consensus estimate from LSEG/Reuters.

Marriott CFO Leeny Oberg said on the analyst call that the company was seeing softer demand in its more affordable U.S. hotel segments.

Oberg also flagged limited visibility for the second half of the year, pointing to shorter booking windows and growing consumer caution around travel spending.

For the first quarter, Marriott earned a $2.32 per share profit, on an adjusted basis, on revenue of $6.26 billion. Both the top and bottom lines were above analysts' estimates.

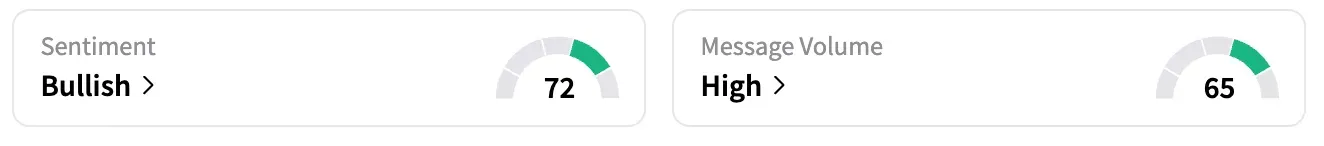

On Stocktwits, sentiment jumped to 'extremely bullish' as of late Tuesday from 'neutral' the previous day.

Marriott shares are down 9.7% year to date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2215875671_jpg_b63edc641f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_hassett_jpg_1eb8c227c7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229940320_jpg_5bc20a70df.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2216479170_jpg_edce233c83.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)