Advertisement|Remove ads.

Oscar Health Stock Surges Over 6% After Hours As House Backs Obamacare Subsidies

- Shares rose in extended trading as the House vote approved a three-year extension of ACA subsidies.

- Investors shrugged off the disclosure of a CTO share sale.

- The bill now moves to the Senate, where approval remains uncertain.

Oscar Health Inc. shares surged over 6% in after-hours trading on Thursday, as investors focused on a legislative development supporting Affordable Care Act (ACA) subsidies, overshadowing a newly disclosed insider share sale by the company’s chief technology officer.

ACA Subsidy Vote

The move came after a vote in the U.S. House of Representatives to renew ACA subsidies for three years. The bill passed 230–196, with 213 Democrats and 17 Republicans voting in favor, extending Obamacare tax credits that had expired at the end of 2025. The legislation will now move to the Senate for consideration.

Insider Sale Disclosed

Separately, Mario Schlosser, Oscar Health’s President of Technology and Chief Technology Officer, sold 76,962 shares of Class A common stock on Tuesday at a weighted average price of $17.01 per share, for proceeds of about $1.31 million.

Political Pushback Highlights Subsidy Debate

The House vote also reignited criticism from Republicans who oppose extending the subsidies. Congressman John Rose said on X that the fight over healthcare centered on efforts to mask failures of Obamacare while benefiting large insurers.

Rose said that since Obamacare's launch in 2014, the seven largest health insurers have tripled their revenues, from $511 billion to $1.5 trillion in 2024. He further stated that subsidies, paid for by taxpayers, were going toward higher premiums under the ACA, and he claimed that subsidies in the Covid era had “magically” outpaced the S&P 500 and the Dow. Rose also linked the extensions to higher premiums, rising national debt, and increased deficit spending.

Political Uncertainty Remains In The Senate

However, the subsidy extension remains unclear despite passage in the House. In December 2025, the Senate voted down a comparable three-year extension. Minority Leader Hakeem Jeffries said in a press conference ahead of the vote that extending the tax credits was the right move, even if more work was needed to ensure final passage.

The Congressional Budget Office estimated that the bill would increase the U.S. deficit by nearly $80.6 billion over ten years, while also leaving 100,000 more people covered by health insurance in 2026, three million more in 2027, four million more in 2028, and 1.1 million more in 2029.

How Did Stocktwits Users React?

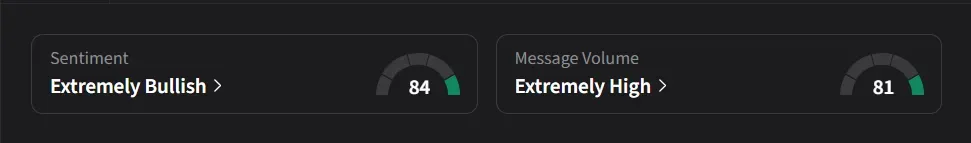

On Stocktwits, retail sentiment for Oscar Health was ‘extremely bullish’ amid ‘extremely high’ message volume.

One user said the stock could reach the $20-$22 range soon, who had expected a move toward $20 in after-hours trading.

Another user said the stock has “enough juice to pump to $30 while senate makes a decision then ATH once passed”

Oscar Health’s stock has risen 11% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_fsd_jpg_e90331e6a6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2210921290_jpg_46bb1e6211.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_figma_original_jpg_90603f536b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213245133_jpg_7b8ad24799.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Carvana_jpg_86121a5fd5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1234770702_jpg_792acca270.webp)