Advertisement|Remove ads.

Mastercard Stock In Retail Spotlight After Upbeat Q3 Earnings: Retail Sentiment Spikes

Shares of Mastercard Inc ($MA) were trading marginally in the green on Thursday after the company’s third quarter earnings topped Wall Street estimates.

Net revenue rose 13% year-over-year (YoY) to $7.37 billion, beating an estimate of $7.27 billion. Earnings per share came in at $3.89 versus an estimate of $3.74 while net income rose 2% YoY to $3.3 billion.

Meanwhile, global purchase volume increased 11% YoY to $2.058 trillion compared to one estimate of $2.054 trillion.

CEO Michael Miebach said the results reflect healthy consumer spending and ongoing solid demand for our value-added services and solutions.

“We continue to invest in our suite of differentiated services to grow our addressable market, protect the ecosystem and add value in every transaction. This includes the planned acquisitions of Recorded Future and Minna Technologies, which are expected to add leading AI-powered threat intelligence and subscription management capabilities to meet the needs of our customers,” he said.

The company repurchased 6.3 million shares at a cost of $2.9 billion and paid $611 million in dividends during the third quarter.

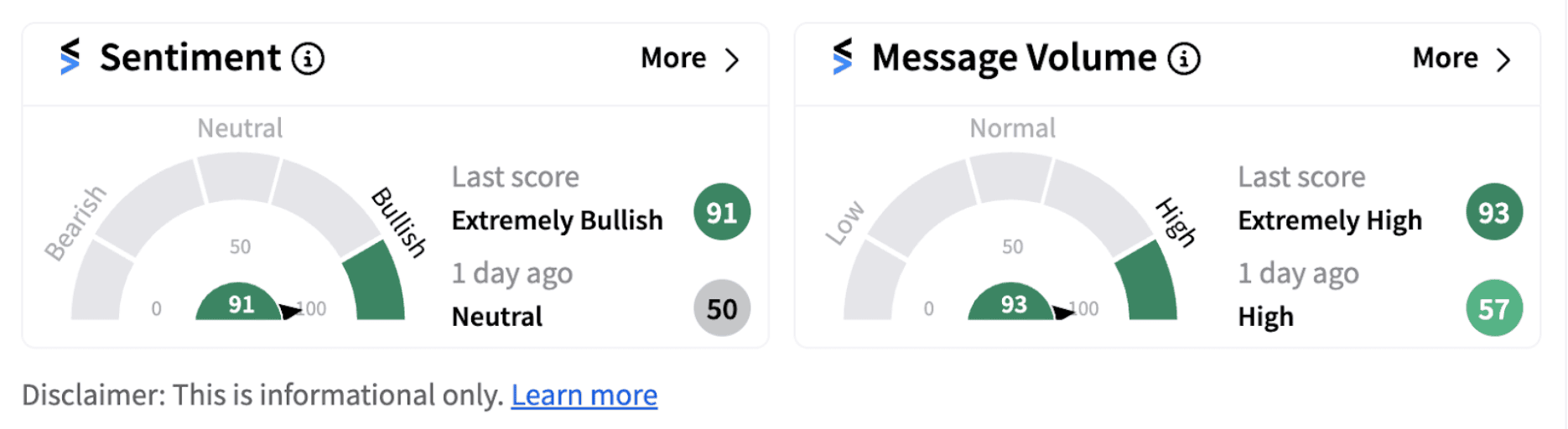

Following the earnings release, retail sentiment on Stocktwits jumped into the ‘extremely bullish’ territory (91/100), from the ‘neutral’ zone a day ago.

Many Stocktwits users believe the stock is set for a rally in the coming times.

Notably, Mastercard has announced a string of acquisitions in recent times. Earlier this month, the company had announced it is set to acquire subscription management firm Minna Technologies. Minna Technologies is a Sweden-based firm that partners with top-tier banks, fintechs and subscription businesses across the U.S., U.K. and Europe to provide subscription management services.

Mastercard had also announced it will acquire threat intelligence firm Recorded Future from Insight Partners for $2.65 billion.

Also See: Uber Stock Dips Premarket As Q3 Gross Bookings Disappoint: Retail Reaction Mixed

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246580703_jpg_9700e1e7e8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2189643067_jpg_243b1172b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1494564204_jpg_be6f667516.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259256580_jpg_e72ea8ddc5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_supermicro_resized_jpg_95d12828d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_UWM_resized_f22f7e06b8.jpg)