Advertisement|Remove ads.

Medtronic Q2 Preview: Wall Street Expects Healthy Quarter As MedTech Giant Looks ‘Confidently Ready’ For US Robotics Push

- Analysts have raised price targets in recent weeks, citing improved sentiment and clearer catalysts heading into earnings.

- Medtronic’s governance refresh and new board committees have strengthened expectations for margin expansion.

- Investors will watch for updates across renal denervation, robotics, and other pipeline programs.

Medtronic will report fiscal second-quarter (Q2) results on Tuesday, with Wall Street expecting modest revenue and earnings growth as analysts assess updated forecasts, recent board and governance changes, and the company’s progress across major pipeline programs.

Koyfin analysts expect a steady quarter, with revenue estimates of $8.86 billion, up 3.8% year over year. EBITDA is forecast at $2.44 billion, while EBIT is projected at $2.15 billion, reflecting growth of 5.7% and 6.9%, respectively. GAAP EPS is expected at $0.95, compared with $0.81 a year ago, while adjusted EPS is forecast at $1.31, up from $1.26.

Analysts Lift Price Targets Ahead Of Results

In the weeks leading up to the Q2 release, several brokerages raised their price targets on Medtronic. Last week, JPMorgan increased its price target to $100 from $90 and kept a ‘Neutral’ rating.

Last month, Truist lifted its target to $103 from $96 and reiterated a ‘Hold’ rating, saying it expects “healthy” quarterly revenue and earnings across its MedTech coverage but warned of “stock volatility” and noted that new money felt “notably absent” from the space.

RBC Capital raised its price target to $111 from $103 on Oct. 10, maintaining an ‘Outperform’ rating. The firm said sentiment toward Medtronic had “continued to improve in recent months” and pointed to opportunities arising from valuation dislocations.

Stifel increased its target to $105 from $90 on Oct. 9, keeping a ‘Hold’ rating after hosting an investor tour of Medtronic’s Boston HUGO robotics facility. The firm said Medtronic “appears confidently ready” for a U.S. launch from a supply chain, manufacturing, and physician support standpoint.

Citi also raised its price target to $112 from $101, maintaining a ‘Buy’ rating. The firm said it remained cautious heading into the quarterly MedTech season but noted the ongoing Section 232 investigation into medical equipment and devices would take time.

Governance Changes

Medtronic added industry veterans John Groetelaars and Bill Jellison to its board as independent directors in August, following Elliott Investment Management's disclosure of a sizeable stake. At the same time, the company formed two new committees focused on evaluating tuck-in deals, R&D investment, and potential divestitures, and on aligning governance with efforts to improve operational performance and margins.

Elliott partner Marc Steinberg said the firm became one of Medtronic’s largest investors because it saw the company entering “a new chapter of value creation” supported by recent innovations.

Renal Denervation And Robotics In Focus

Last month, Medtronic reported three-year data from the SPYRAL HTN-ON MED trial showing sustained reductions in ambulatory and office-based systolic blood pressure with its Symplicity Spyral renal denervation system, with no renal artery stenosis above 70% observed through the period. The company said more than 5,000 patients have been studied and over 30,000 procedures performed globally with the system.

The company also launched the Embrace Gynecology IDE study for its HUGO robotic-assisted surgery platform in the U.S., following completion of the first hysterectomy procedures in Pittsburgh, with the trial planning to enrol up to 70 patients across multiple sites.

Stocktwits Users Flag Post-Earnings Dip Pattern

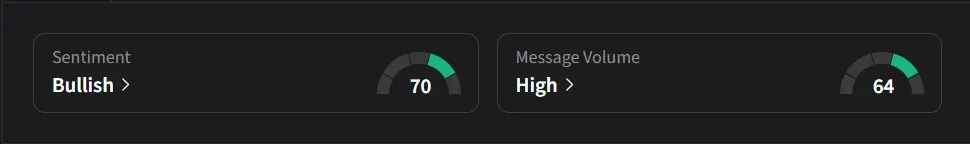

On Stocktwits, retail sentiment for Medtronic was ‘bullish’ amid ‘high’ message volume.

One user expects the stock to hit $100, while another said the pattern has been for shares to fall after earnings and rise again ahead of the dividend cutoff date.

Medtronic’s stock has risen 23% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_anthropic_OG_jpg_51bd14bc5d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Goldman_Sachs_resized_c6a47f630c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_cybertruck_jpg_7f6ed70b80.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Nebius_jpg_291bb409c7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202349941_jpg_3f45878d03.webp)