Advertisement|Remove ads.

Merck Stock Heads For 5th Day Of Losses As TD Cowen Downgrades On Gardasil Woes, But Retail Holds Strong

Shares of Merck & Co. Inc. fell more than 0.5% on Monday afternoon, tracking their fifth consecutive decline in the worst losing streak since mid-November.

The drop followed a downgrade by TD Cowen, which cut its rating to 'Hold' from 'Buy' and lowered its price target to $100 from $121. Despite the cut, the new target still implies a 15% upside from current levels.

TD Cowen said its bullish thesis on Merck had "broken down" due to mounting uncertainty around the company's HPV vaccine, Gardasil, in China.

The downgrade also comes as Merck nears a critical period with its blockbuster cancer drug Keytruda, which will lose U.S. patent exclusivity in 2028 and European protection in 2031.

Last week, Merck's stock tumbled after the company issued a weak 2025 outlook, overshadowing its stronger-than-expected fourth-quarter earnings.

A major factor in the disappointing guidance was Merck's decision to halt shipments of Gardasil to China starting in February 2025, with no clear timeline for resumption until at least mid-year.

The vaccine had been a key growth driver in China until last year when economic headwinds disrupted demand. The company has since emphasized efforts to boost patient education and promotional activities to regain lost momentum.

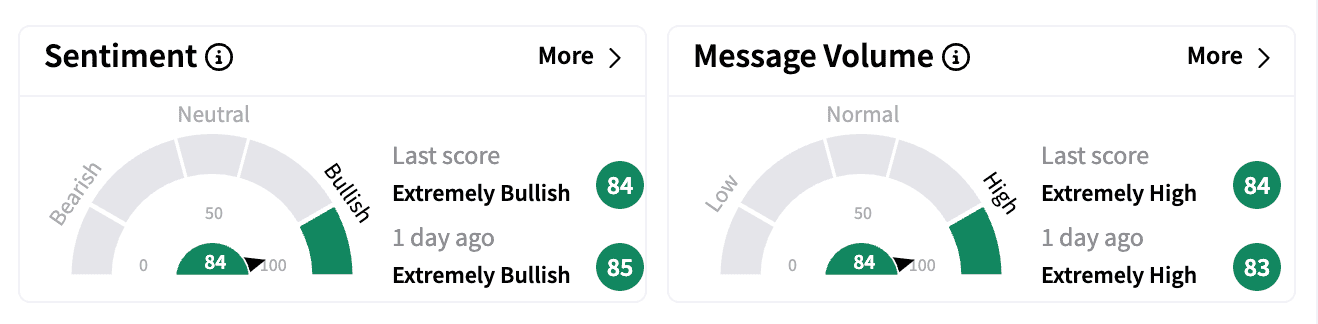

Retail investors, however, remain upbeat. On Stocktwits, sentiment turned 'extremely bullish' by Tuesday afternoon, with a surge in message volume.

Some traders pointed to technical factors, calling the stock oversold and due for a bounce.

One user highlighted Merck's strong drug pipeline, arguing that the company has "too many potential blockbusters" to offset Keytruda's looming patent cliff.

Merck's stock has fallen more than 31% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Sam_Altman_1200pi_resized_jpg_a180a65511.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_540198451_jpg_3e5f3d8ee7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202831815_jpg_e9c998f956.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Core_Weave_jpg_b1a99c6298.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243572319_jpg_90770a5e51.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_Social_logo_1200_Px_resized_jpg_86883cac04.webp)