Advertisement|Remove ads.

Merus Stock Soars On Positive Phase 2 Drug Trial Data, Price Target Hikes: Retail’s Thrilled

Shares of Merus N.V. (MRUS) rocketed 32% on Friday morning after the stock witnessed price target hikes on the heels of the company announcing positive data from one of its ongoing drug trials.

Oncology company Merus on Thursday said that the combination of bispecific antibody Petosemtamab with Pembrolizumab demonstrated robust efficacy and durability in its ongoing phase 2 trial as of Feb. 27.

Merus CEO Bill Lundberg said the data from the trial demonstrates that Petosemtamab in combination with Pembrolizumab can become “a new standard of care" in head and neck cancer and is “significantly better” than treatment with just Pembrolizumab.

The company said that as of Feb. 27, 45 patients had been treated in the phase 2 trial, and the combination was generally well tolerated.

The CEO also expressed optimism about sharing data from one or both of its late-stage combination trials in 2026.

BofA on Friday hiked the price target on Merus to $92 from $70 while keeping a ‘Buy’ rating on the shares. The firm noted that the recently announced data set the combination as "the best-in-class treatment option for this patient population."

The analyst’s new price target implies a 121% upside to Merus’s closing share price of $41.6 on Thursday.

BMO Capital also hiked the price target on Merus to $110 from $96 on Friday while keeping an ‘Outperform’ rating on the shares. BMO said it sees a 90% probability of the combination's approval for treating head and neck cancer.

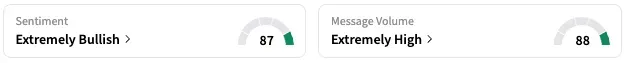

On Stocktwits, retail sentiment around Merus jumped from ‘bearish’ to ‘extremely bullish’ territory over the past 24 hours while message volume jumped from ‘normal’ to ‘extremely high’ levels.

MRUS stock is up by about 30% this year and 25% over the past 12 months.

Read Next: JPMorgan, Bank of America, Citigroup, Wells Fargo Reportedly Explore Joint Stablecoin

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)