Advertisement|Remove ads.

Meta Tops Q4 Estimates But Offers Lukewarm Guidance: Retail Gets Euphoric As Capex Ramps Up

Meta Platforms, Inc. (META) stock climbed in Thursday’s premarket session after the social media giant posted stronger-than-expected fiscal 2024 fourth-quarter results. However, the midpoint of its first-quarter revenue guidance fell below expectations.

In premarket trading, the stock rose 1% to $683.21.

Q4 Result

The Menlo Park, California-based company reported fourth-quarter earnings per share (EPS) of $8.02, well above the consensus estimate of $6.76 and the year-ago figure of $5.33.

Revenue grew 21% year-over-year to $48.39 billion, surpassing the consensus estimate of $46.99 billion and Meta’s guidance of $45 billion–$48 billion. Advertising revenue accounted for 96.7% of the total, while Reality Labs contributed $1.08 billion.

Costs and expenses edged up just 5%, helped by a $1.55 billion reduction in accrued legal losses.

Operating margin expanded to 48%, up from 41% in the fourth quarter of 2023.

Daily active people (DAP) across Meta’s family of apps reached 3.35 billion, up from 3.29 billion in September and marking a 5% year-over-year increase. Ad impressions rose 6%, while the average price per ad climbed 11%.

Mark Zuckerberg, Meta’s founder and CEO, said, “We continue to make good progress on AI, glasses, and the future of social media.”

Forward Outlook

Meta expects first-quarter revenue between $39.5 billion and $41.8 billion, compared to the consensus estimate of $41.48 billion, according to Yahoo Finance.

For fiscal 2025, the company anticipates strong revenue growth driven by continued investments in its core business.

Capital expenditures are projected to rise over 50% to $60 billion–$65 billion, up from $39.23 billion in 2024. “We expect capital expenditure growth in 2025 to be driven by increased investment in both our generative AI efforts and core business,” Meta added.

A wave of Wall Street analysts raised their price targets on the stock, with estimates ranging from $770 to $820, The Fly reported. Benchmark upgraded the stock to ‘Buy’ from ‘Hold,’ setting a price target of $820.

Retail Upbeat

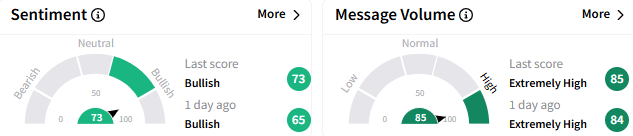

On Stocktwits, sentiment toward Meta stock improved to ‘extremely bullish’ from ‘bullish’ a day ago, with message volume staying at ‘extremely high’ levels.

Traders on the platform were anticipating further gains into the first quarter, with one predicting a rally to $980 by the time Meta reports Q1 results.

Another highlighted the company’s vast active user base as a major asset for its AI personal assistant.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263890310_jpg_1f5b1fba80.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2185274983_jpg_0354a0740b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_x_0d62438a6d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)