Advertisement|Remove ads.

Meta Announces $600 Billion US Investment Plan To Strengthen AI Data Centers

- In September, the tech giant had revealed a $600 billion investment by 2028.

- Since 2010, the company’s data center development projects have supported more than 30,000 skilled trade jobs.

- CFO Susan Li stated on the earnings call that capital expenditures dollar growth will be notably higher in 2026.

Meta Platforms Inc. (META) announced on Friday that it will invest $600 billion to expand AI data centers, enhance technology capabilities, and grow its domestic workforce by 2028.

In September, the tech giant had revealed a $600 billion investment by 2028, aimed at strengthening U.S. artificial intelligence (AI) infrastructure and boosting local economies.

Expanding AI infrastructure

Meta said that these investments will establish “industry-leading AI data centers” across the U.S. to help advance its vision of creating personal superintelligence for users.

Since 2010, the company’s data center development projects have supported more than 30,000 skilled trade jobs and 5,000 operations roles nationwide.

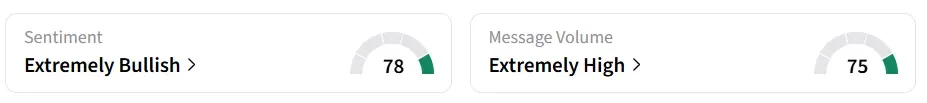

Meta Platforms’ stock traded over 1% lower on Friday afternoon. On Stocktwits, retail sentiment around the stock remained in ‘extremely bullish’ territory amid ‘extremely high’ message volume levels.

Q3 Earnings Impact

The company's third-quarter earnings per share (EPS) were impacted by a one-time tax provision, but revenue exceeded the Street estimate.

Since its Q3 earnings on October 29, the stock has been under pressure due to concerns about increased capital expenditures. The company expects 2025 capital expenditures (capex) of $116 billion to $118 billion, with the lower end revised from the earlier forecast of $114 billion.

Additionally, CFO Susan Li stated on the earnings call that capital expenditures dollar growth will be notably higher in 2026 and that total expenses will grow at a significantly faster rate.

Meta recently secured a $27 billion funding agreement with Blue Owl Capital to support the construction of its largest data center project worldwide.

Meta’s spending spree reflects the efforts of major tech firms to expand the infrastructure needed to fuel their growing artificial intelligence initiatives.

Meta Platforms’ stock has gained over 2% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_strait_of_hormuz_jpg_456f2fb6d3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sharp_Link_Gaming_jpg_60ce5684e3.webp)