Advertisement|Remove ads.

Meta Stock On Track To Break Below $500 As Investors Shrug Off Llama 4 AI Model Launch Amid Tariff Concerns: Retail's Cautious

Meta Platforms, Inc. (META) stock is poised to breach the $500 support level on Monday as investors continue to remain nervous about the impact of President Donald Trump’s reciprocal tariffs.

The pessimism surrounding the tariff-led rout was so strong that the launch of the latest iteration of Meta’s large-language model (LLM) failed to rev up investor sentiment.

The social-media giant’s stock is on track to start Monday’s session below the $500 mark for the first time in eight months.

On Saturday, Meta announced the first models of Llama 4, the company’s next iteration of open-source artificial intelligence (AI) models. Among the models unveiled are:

- Llama 4 Scout, a 17 billion active parameter model with 16 experts, which will help people build more personalized multimodal experiences; It delivers better performance than Alphabet, Inc.’s (GOOGL) (GOOG) Gemma 3, Gemini 2.0 Flash-Lite, and French AI startup Mistral AI’s Mistral 3.1.

- Llama 4 Maverick, a 17 billion active parameter model with 128 experts. Meta said it is the best multimodal model in its class, beating OpenAI’s GPT-4o and Gemini 2.0 Flash and achieving comparable reasoning and coding results to DeepSeek’s v3.

- Llama 4 Behemoth, a 288 billion active parameter model with 16 experts

Meta said the Llama 4 Behemoth is its most powerful yet and among the world’s smartest LLM, outperforming OpenAI’s GPT-4.5, Anthropic’s Claude Sonnet 3.7, and Gemini 2.0 Pro on several STEM benchmarks.

The Behemoth is still training, while Scout and Maverick could be downloaded immediately.

Separately, a Bloomberg report said Meta plans to spend nearly $1 billion on a data center project in Wisconsin, ramping up investments in AI and cloud infrastructure.

In another development, Jefferies analyst reduced the price target for Meta stock to $600 from $725, citing rising tariff uncertainty, TheFly reported.

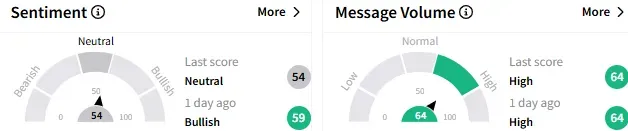

On Stocktwits, retail sentiment toward Meta stock turned to ‘neutral’ (54/100) from the ‘bullish’ mood that prevailed a day ago. The message volume stayed ‘high.’

The bearish sentiment toward Meta stock is based on expectations that Trump's tariffs will lead to a protracted sell-off in the market.

On the other hand, a bullish watcher premised his optimism on potential tariff relief as countries begin to negotiate with the U.S.

Meta stock fell 2.32% to $493 in Monday's premarket trading. The stock has shed about 14% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254648547_jpg_a843db78b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1000648682_jpg_6aa61e3574.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259602028_jpg_5b1a490e64.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259775985_jpg_a06a1e88c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_dogecoin_OG_2_jpg_304df31f25.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vitalik_buterin_OG_jpg_7ac8ea93fe.webp)