Advertisement|Remove ads.

Michael Burry Tears Into Nvidia After Q3, Flags Gaping Accounting Holes Tied To Stock-Based Compensation

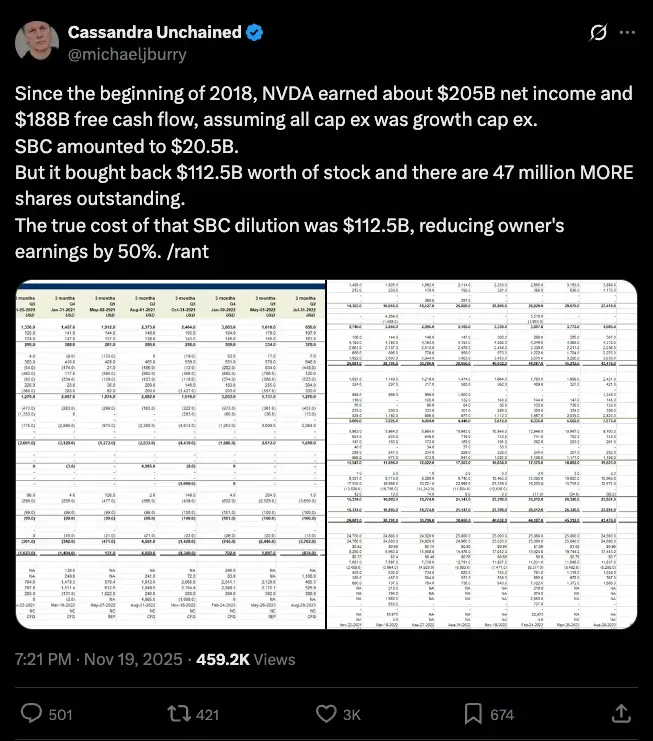

- The hedge fund manager believes the actual cost of Nvidia's stock-based compensation dilution since 2018 would have been $112.5 billion, not the $20.5 billion it reported.

- If so, Nvidia’s earnings for the period may have been cut by 50%.

- Sharing a chart, showing circular deals in the AI space, Burry said every company in the loop has “suspicious revenue recognition.”

“The Big Short” fame investor Michael Burry has been quite vocal on X in the run-up to the Nov. 25 launch of his venture. This time around, he chose to launch a tirade against artificial intelligence (AI) chipmaker Nvidia Corp. (NVDA), capitalizing on the interest surrounding the company amid its quarterly results announcement.

Nvidia's stock rose more than 5% in extended trading following its blowout quarter. That comes as much-needed relief as fears of an AI bubble have dented sentiment toward the broader market and tech sector. The SPDR S&P 500 ETF (SPY) and the Invesco QQQ Trust (QQQ), the exchange-traded funds tracking the S&P 500 and the Nasdaq 100 indices, have lost about 3% and 4.6%, respectively, since the start of November.

Questioning Nvidia’s Accounting?

Burry, credited with accurately predicting the 2018 housing market collapse, said in a late Wednesday post on X that Nvidia’s stock-based compensation (SBC) since the beginning of 2018 was $20.5 billion. SBC is a non-cash payment to employees made in the form of stock and options.

Burry contends that Nvidia’s SBC during the period would have been much more. He noted that the Jensen Huang-led company repurchased $112.5 billion in stock during the period, yet there are 47 million more shares outstanding than before. The hedge fund manager believes the actual cost of SBC dilution was $112.5 billion, not the $20.5 billion the company used.

Nvidia earned $205 billion in net income and $188 billion in free cash flow, assuming all capital expenditure (capex) was growth capex, Burry said. With the $112.5 billion SBC dilution, Nvidia’s earnings for the period may have been cut by 50%, he added. Some social media users, however, did not buy this argument, with one arguing that Burry double-counted the dilution.

The Circular Deals

Burry also shared a chart titled "How Nvidia and OpenAI Fuel the AI Money Machine" based on Bloomberg news reports on X, which visualizes the interconnected web of investments, partnerships, services, and capital flows in the AI ecosystem, totaling over $1 trillion in value. The companies featured in the chart, apart from the titular names, include Microsoft, AMD, Oracle, CoreWeave, Elon Musk's xAI and even smaller AI players such as Mistral and Figure AI.

"Every company listed below has suspicious revenue recognition. The actual chart with ALL the give-and-take deals would be unreadable. The future will regard this a picture of fraud, not a flywheel," Burry wrote. "True end demand is ridiculously small. Almost all customers are funded by their dealers. If you can name OpenAI's auditor in 1 hour you win some pride."

A circular deal is a financial arrangement in which two or more companies exchange money in a loop. In the latest deal announced earlier this week, Amazon-backed AI startup Anthropic agreed to buy $30 billion in Azure compute capacity from Microsoft. In turn, Nvidia and Microsoft have decided to invest up to $10 billion and up to $5 billion, respectively, in Anthropic.

Nvidia CEO Jensen Huang shrugged off the risk on the company’s earnings call late Wednesday, saying the chipmaker sees something different. He also said Nvidia’s balance sheet is sufficient to support its partners and that all investments are aimed at expanding the reach of its CUDA systems.

Extending Useful Life

Burry, who earlier called out hyperscalers such as Oracle, Meta, and Baidu for artificially boosting profits by extending the useful life of AI infrastructure assets, offered more clarity on his thinking. “The idea of a useful life for depreciation being longer because chips from more than 3 to 4 years ago are fully booked confuses physical utilization with value creation,” Burry said. He contended that just because something is used does not mean it is profitable.

Burry noted that Nvidia’s A100s used two to three times more power and therefore consumed two to three times more electricity than the next iteration, the H100 AI chips, and that the H100 is about 25 times less energy efficient than Blackwell for inference. “If that is the direction you are going, chances are you have to be doing it, and it is not pleasant.”

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Summary: Why Palo Alto Stock Fell Over 3% After-Hours

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)