Advertisement|Remove ads.

Michael Saylor's Strategy Stock Draws Retail Traders' Attention as Bitcoin Hits Another Peak — Is $400 Next?

Michael Saylor's Strategy drew retail buzz on Stocktwits late Sunday, with investors upbeat about the stock following a sharp rally in Bitcoin.

The price of Bitcoin has risen nearly 11% over the last seven days, hitting an all-time high of $125,449.77 on Sunday, according to CoinMarketCap. Shares of Strategy, formerly MicroStrategy, one of the first companies to store its cash reserves in the form of Bitcoin, rose nearly 17% from its recent low on Sept. 25.

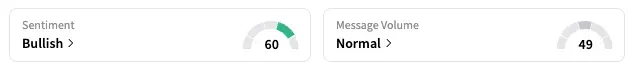

On Stocktwits, MSTR was among the top-trending tickers late Sunday. Retail sentiment for the stock shifted to 'bullish' from 'neutral' over the weekend, with users eying a breakout and $400 price.

"NAV will start to expand this week, $400 is possible," forecasted a user, with another saying, "once we break key points 358 and 367, the sky is the limit."

Since 2020, Strategy has been accumulating Bitcoin and is today one of the largest corporate holders of the cryptocurrency. Its move, which closely links the company's asset value and share price to the BTC price, has prompted several companies to adopt cryptocurrencies as a treasury asset or launch services centered around these digital assets.

President Donald Trump's crypto-friendly stance and the U.S. advancing a series of crypto bills in recent months have only further expanded the trend, with more companies setting up crypto reserves to capitalize on the rising prices.

GameStop is one of the more prominent companies to adopt Bitcoin as a treasury asset earlier this year. Notably, the GME stock fell sharply, by 8.3% in the last two sessions, amid the company's special warrant issue on Friday.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231423801_jpg_f64bcdbb33.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2242062032_jpg_b5e44cfa75.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Trade_desk_logo_resized_c0229eb2ab.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217651250_jpg_908ef236f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194622714_jpg_c18475d557.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)