Advertisement|Remove ads.

MicroCloud Hologram Stock Craters To Record Low After $200M Bitcoin Investment Plan: Retail Remains Unconvinced

MicroCloud Hologram (HOLO) shares fell more than 5% on Monday after the company announced plans to invest up to $200 million in Bitcoin and other digital assets.

The stock is now trading at an all-time low of $1.28, marking a near-total collapse of 99.6% over the past 12 months.

The technology services firm specializing in holographic AI and quantum computing disclosed that it currently holds approximately $257 million in cash reserves.

It said the planned investment would focus on Bitcoin, other digital currencies with "market impact and growth potential," and derivatives tied to the sector.

MicroCloud framed the move as a strategic bet on the digital currency market, aiming to integrate its core technologies with blockchain applications.

"As an emerging financial tool and payment method, digital currency has unique advantages such as decentralization, high transparency, and fast transaction speed," the company stated.

However, the announcement sparked mixed reactions among investors.

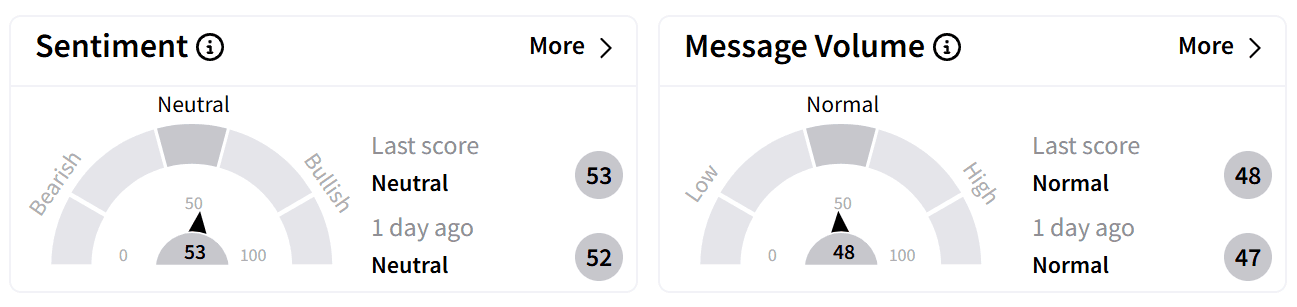

On Stocktwits, retail sentiment around the stock remained ‘neutral’ accompanied by ‘normal’ levels of chatter.

Some users compared MicroCloud’s strategy to MicroStrategy’s Bitcoin-heavy balance sheet, while others questioned whether the funds could be put to better use.

MicroCloud Hologram’s steep decline has accelerated in 2025, with shares now worth a fraction of their former value.

The latest drop follows a broader trend of skepticism surrounding the company’s financial stability and strategic direction.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_hawaiian_electric_resized_4b766fd741.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)