Advertisement|Remove ads.

ON Semiconductors Falls To Over 2-Year Lows On Q4 Earnings Miss, Weak Guidance: Retail Turns Extremely Bearish

ON Semiconductor Corp. (ON) stock tumbled over 6% to over 2-year lows as retail sentiment on Stocktwits dipped to ‘extremely bearish’ on Monday morning, after the company missed estimates for its fourth quarter earnings and issued worse-than-expected guidance.

The time the stock was seen trading at these levels was in July 2022.

The chipmaker reported earnings per share (EPS) of $0.95, missing Wall Street’s estimate of $0.97.

Revenue came in at $1.72 billion, falling short of the $1.76 billion consensus forecast, according to Koyfin.

CEO Hassane El-Khoury sought to reassure investors, emphasizing that ON Semiconductor remains structurally resilient despite current market volatility.

"As we continue to navigate this downturn, our actions over the last four years have proven we are a structurally different company that is well-equipped to manage prolonged uncertainty," he said.

ON Semiconductor's three core business units all posted year-over-year revenue declines.

The Power Solutions Group, its largest segment, saw revenue fall 16% to $809.4 million.

The Advanced Solutions Group, which includes mixed-signal and analog semiconductor products, reported an 18% decline to $610.6 million.

The Intelligent Sensing Group, which develops image processors and sensor technologies, generated $302.5 million in revenue — up 9% sequentially but down 2% from the prior year.

For the upcoming quarter, ON Semiconductor projected EPS between $0.45 and $0.55, well below the $0.89 consensus.

The company also guided revenue in the range of $1.35 billion to $1.45 billion, missing analysts’ expectations of $1.70 billion.

“While 2025 remains uncertain, we remain committed to our long-term strategy,” noted El-Khoury.

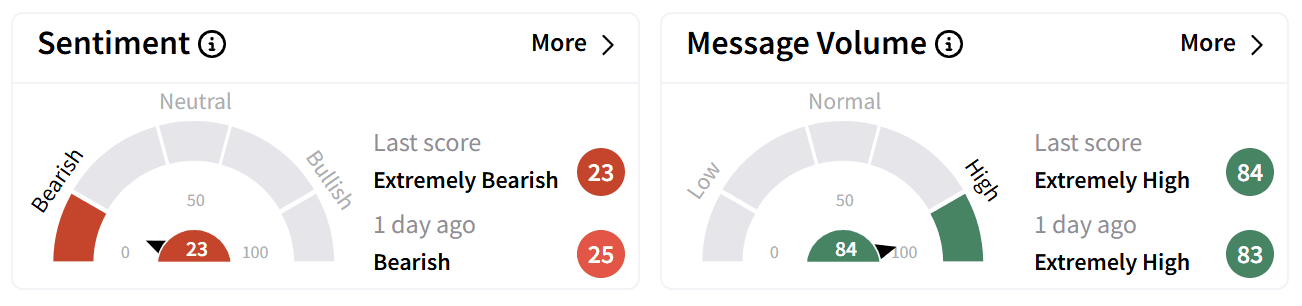

Retail sentiment on Stocktwits, which was already ‘bearish’ ahead of the earnings, deteriorated further to ‘extremely bearish’ after the results, as message volume remained at ‘extremely high’ levels.

Management commentary during the earnings call failed to impress investors on the platform.

The stock has been in a downtrend since November, losing more than 40% over the past 12 months. Year-to-date, ON Semiconductor shares are down about 24%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: These 3 Semiconductor Stocks Drew The Most Retail Buzz Last Week

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228736233_jpg_f3ebe80a4c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Cybersecurity_jpg_bb1da91dbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Vanda_jpg_943c16fa4f.webp)