Advertisement|Remove ads.

Micron Stock Falls as CFO Maintains Q2 Outlook, Warns of Margin Pressure in Q3: Retail Eyes Buying Opportunity

Micron Technology Inc. (MU) shares fell more than 3% in morning trading Wednesday after the company’s CFO signaled no changes to its second-quarter (Q2) guidance and warned of margin pressures in the third quarter.

Speaking at the Wolfe Research Auto, Auto Tech, and Semiconductor Conference, CFO Mark Murphy reiterated Micron's outlook provided on Dec. 18, stating there would be “no change or update,” according to a transcript from Koyfin.

The computer memory manufacturer has forecast adjusted earnings between $1.33 and $1.53 per share for the quarter, with analysts surveyed by Koyfin currently expecting $1.44 per share.

Murphy cautioned that third-quarter gross margins are expected to decline “by a few hundred basis points sequentially” due to shifts in Micron’s customer mix and broader industry conditions.

Looking ahead, he suggested that industry dynamics could support improved margins beyond the fiscal third quarter. He pointed to rising data center demand, better smartphone inventory levels, and reductions in NAND memory supply as potential tailwinds.

“We do see second-half bits being stronger than first-half bits. So these are just stronger signs for our, later in the year, industry conditions,” Murphy said.

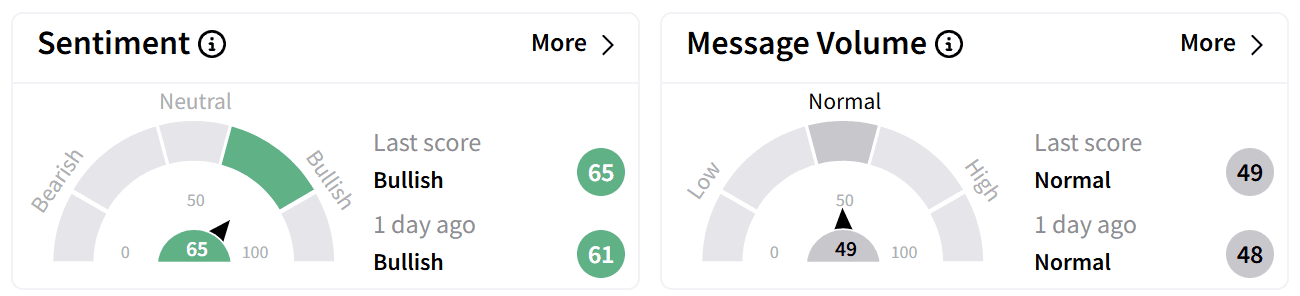

On Stocktwits, retail sentiment around Micron remained in the ‘bullish’ territory accompanied by ‘normal’ levels of chatter. Some investors expressed frustration with Murphy’s remarks, criticizing the company for reinforcing a cautious outlook.

Others consider the stock’s dip as an overreaction.

Despite Wednesday’s decline, Micron shares remain up more than 7% year-to-date.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)