Advertisement|Remove ads.

Barrick Stock Jumps On Q4 Beat, Doubling Free Cash Flow: Retail Hedges Inflation Blues With Gold’s Safe-Haven Strength

Barrick Gold (GOLD) stock surged over 6% on Wednesday morning after the miner posted better-than-expected earnings, bolstered by higher production and improved cash flow.

The stock was among the top trending tickers on Stocktwits.

The company reported earnings of $0.46 per share for the fourth quarter (Q4), beating Wall Street’s estimate of $0.42, according to Stocktwits data.

However, revenue fell short at $3.65 billion, missing the $3.95 billion consensus forecast.

For the full year, net income surged 69% to $2.14 billion, while adjusted net earnings climbed 51% to $2.21 billion.

Earnings before interest, taxes, depreciation and amortization (EBIDTA) rose 30% to $5.19 billion, marking its highest level in more than a decade.

Operating cash flow increased 20% year-over-year to $4.49 billion, while free cash flow more than doubled to $1.32 billion, driven by strong earnings and disciplined cost management, according to management.

Gold production rose 15% in the fourth quarter compared to the previous quarter, while copper output increased 33%.

The company also trimmed its gold cost of sales by 3% and total cash costs by 5%.

Barrick highlighted progress at Pueblo Viejo, where recovery rates improved despite lower production grades. Meanwhile, production at Veladero and Nevada Gold Mines increased, and the company strengthened the management team at its Kibali operation.

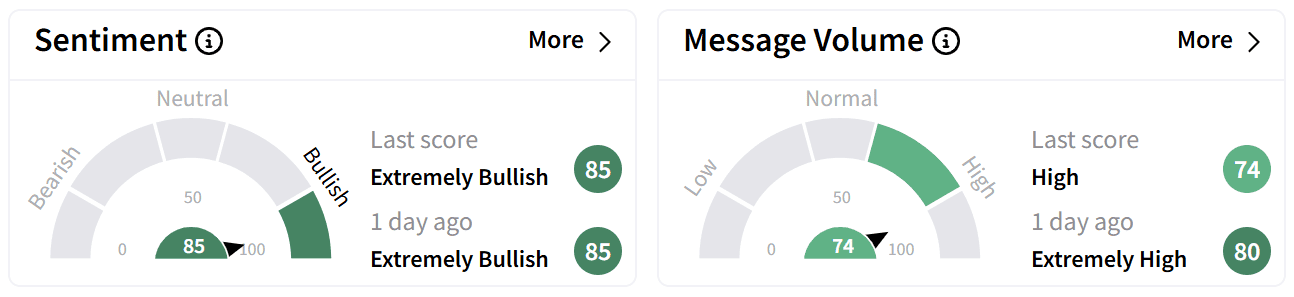

On Stockwits, retail sentiment around the stock remained at year-high levels in the ‘extremely bullish’ zone accompanied by ‘high’ levels of chatter.

Some investors viewed Barrick’s strong earnings as a catalyst for further gains, especially as hotter-than-expected U.S. inflation data supported gold’s appeal as a safe haven.

Others expressed frustration that the stock wasn’t already trading higher despite its record revenue in 2024.

Looking ahead to 2025, Barrick expects gold production to range between 3.15 million and 3.5 million ounces, excluding production from the temporarily suspended Loulo-Gounkoto mine.

Copper production is forecast to rise from 195,000 tonnes in 2024 to between 200,000 and 230,000 tonnes, driven by increased output at Lumwana.

Barrick CEO Mark Bristow emphasized the company's focus on sustainable value creation, highlighting its strong asset quality, balance sheet, and organic growth pipeline.

He reiterated that Barrick is well-positioned to fund its expansion without relying on mergers, acquisitions, or new equity issuance.

Barrick Gold’s stock has gained nearly 16% this year so far.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: Hive Swings To Profit In Q3 But Retail Worries Grow Over Bitcoin Slide, Possible Stock Dilution

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_cybertruck_jpg_7f6ed70b80.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Workday_logo_resized_d2d5258f05.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Lucid_jpg_221b9d07ec.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222819201_jpg_edcbb1336e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)