Advertisement|Remove ads.

Microsoft Hit By Azure, 365 Service Disruptions Ahead Of Q3 Results

- Microsoft reported major outages across Azure and 365 services, affecting multiple platforms including Xbox Live and Office 365.

- Downdetector logged over 20,000 Azure and 11,000 Microsoft 365 issues.

- Alaska Airlines confirmed disruptions to systems hosted on Azure.

Microsoft (MSFT) was hit by outages in its Azure cloud and 365 services on Wednesday, just hours before its scheduled quarterly earnings release later in the day.

MSFT’s stock edged 0.5% lower in midday trade and was among the top trending tickets on Stockwits. Users across regions reported being unable to access Microsoft’s platforms, including websites and applications dependent on Azure infrastructure, such as Xbox Live, Copilot, Office 365, Hotmail, and OneDrive.

According to Downdetector, issues began around 11:40 a.m. ET, with more than 20,000 reported problems on Azure and 11,000 on Microsoft 365. Reports also flagged over 6,000 users experiencing issues with Amazon Web Services (AWS), though AWS’ status page did not indicate active disruptions.

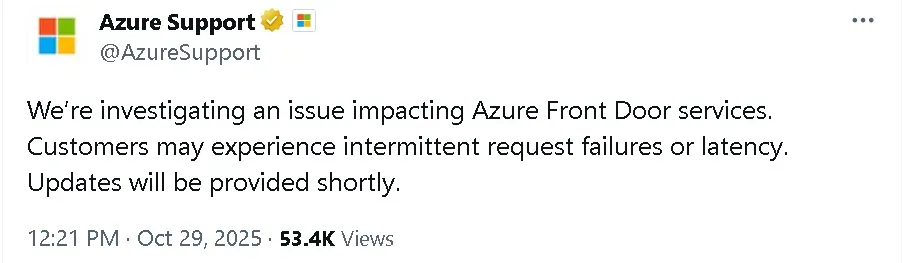

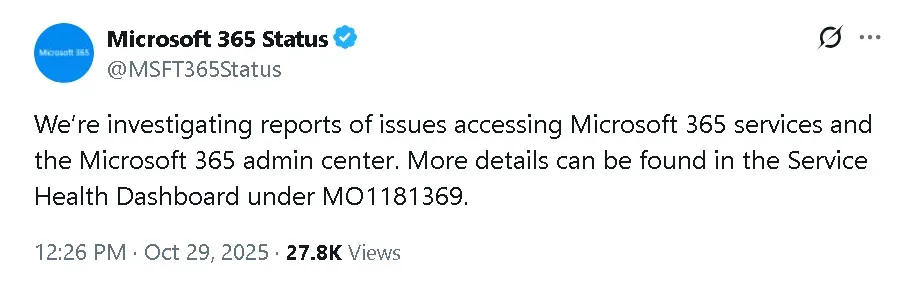

Microsoft has acknowledged the disruption on its Azure and Microsoft 365 support accounts on X. Meanwhile, the AWS status page did not reflect any ongoing issues.

Alaska Airlines Hit By Azure Outage

Alaska Airlines (ALK) said the outage affected “key systems,” including websites hosted on Azure, disrupting several services for both Alaska and Hawaiian Airlines. ALK’s stock dropped nearly 2% in afternoon trade but retail sentiment remained in ‘extremely bullish’ territory amid ‘extremely high’ levels of chatter.

This is the second time this month that a widespread cloud disruption has been reported. A little over a week ago, Amazon Web Services reported a major outage that took down numerous major websites and lasted for hours.

“We suspect that an inadvertent configuration change as the trigger event for this issue,” Azure said on its status page. “We are taking two concurrent actions where we are blocking all changes to the AFD services and at the same time rolling back to our last known good state.” It added that the company does have an estimate on when the rollback will be completed.

Microsoft’s Q3 Earnings Expectations

Microsoft is scheduled to report its third quarter (Q3) earnings, after market close on Wednesday. Wall Street is expecting the company to report $75.39 billion in revenue on earnings per share (EPS) of $3.66, according to Koyfin data.

On Stocktwits, retail sentiment around the tech giant surged higher into ‘extremely bullish’ territory as chatter rose to ‘extremely high’ from ‘high’ levels over the past day.

One retail trader said they expect higher price targets from Wall Street after Microsoft reports its earnings.

Another user opined that the stock may plummet after the results are announced.

Microsoft’s stock has gained nearly 27% this year and around 25% over the past 12 months.

Read also: Bitcoin Slips Ahead Of Fed Rate Cut Decision — Ethereum, Dogecoin Lead Declines

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2207049226_jpg_7f1e685123.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218181377_jpg_f2dccc3db9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2245017747_jpg_f783731632.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_China_i_Phone_jpg_bcedab655a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_American_Airlines_Getty_4d3d704837.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_sabre_resized_jpg_fa5aa35db6.webp)