Advertisement|Remove ads.

Microsoft Stock Trends On Stocktwits After CEO Satya Nadella Unveils Majorana 1 Quantum Computing Chip: Retail’s Exuberant

Software giant Microsoft Corp.’s (MSFT) shares trended on Stocktwits, with retail sentiment improving as investors weighed in on a couple of technology breakthroughs announced on Wednesday.

In a blog post, Microsoft CEO Satya Nadella announced Majorana 1–the company’s quantum processing unit built on a “topological core.” The executive said 20 years of pursuit helped the company create an “entirely new state of matter unlocked by a new class of materials, topoconductors, that enable a fundamental leap in computing.”

Nadella noted that the qubits created with topoconductors are faster, more reliable, smaller, and are 1/100th of a millimeter. “We now have a clear path to a million-qubit process,” he said.

The topological core powering Majorana is reliable by design, incorporating error resistance at the hardware level, ensuring stability.

Microsoft expects the quantum chip to help it develop a “truly meaningful” quantum computer within years.

Incidentally, rival Alphabet, Inc. (GOOGL) (GOOG) announced its “Willow” quantum chip in early December, claiming that it can reduce errors exponentially and perform a standard benchmark computation in under five minutes.

Separately, Microsoft announced Muse, its first World and Human Action Model (WHAM), a generative artificial intelligence (AI) model of video game. Muse can generate game visuals, controller actions, or both.

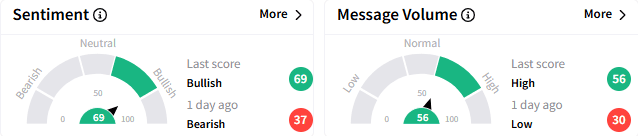

On Stocktwits, retail sentiment toward Microsoft stock turned ‘bullish’ (67/100) from the ‘bearish’ sentiment that prevailed a day ago. The message volume perked up to a ‘high’ level.

The stock was among the top ten trending tickers on the platform.

A watcher said Microsoft stock could explode toward the $500 level on the quantum chip news.

Another user eyed a run-up and a potential split announcement from the company.

In premarket trading, Microsoft stock rose 0.42% to $415.66. The stock is down about 1.6% this year, reversing some of the 13% gain it recorded in 2024.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_capricor_jpg_9f4f8ab098.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233716109_jpg_230d917a7e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Alibaba_jpg_4d8d9521c8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227994766_jpg_090ba3c9b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_michael_saylor_OG_jpg_9d414a2458.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_c9a7452f1f.webp)