Advertisement|Remove ads.

MicroStrategy May Reportedly Owe Taxes On $19B Unrealized Bitcoin Gains: Retail Shrugs It Off

MicroStrategy Inc.’s (MSTR) stock remained flat on Friday, even as other crypto-linked stocks rallied following the U.S. Securities and Exchange Commission’s decision to repeal a rule that limited banks from holding digital assets.

The subdued movement comes as a Wall Street Journal report raised concerns over potential federal taxes on the company’s unrealized Bitcoin gains under the Inflation Reduction Act (IRA), set to take effect in 2026.

According to the report, the IRA’s 15% corporate minimum tax rate could apply to MicroStrategy if its average annual income surpasses $1 billion over three years.

While unrealized gains from traditional equities such as Berkshire Hathaway are exempt from these rules, the Internal Revenue Service (IRS) has yet to extend similar treatment to crypto assets like Bitcoin.

MicroStrategy is actively lobbying for comparable exemptions, with speculation that the company could succeed due to historical pro-crypto policy decisions.

The report also disclosed that new tax and accounting regulations could increase the company’s retained earnings by $12.8 billion—part of its shareholder equity—and create up to $4 billion in deferred tax liabilities depending on Bitcoin’s price trajectory.

Despite these potential liabilities, MicroStrategy’s market value of $92 billion remains well above the value of its Bitcoin holdings of 461,000 BTC valued at $49 billion.

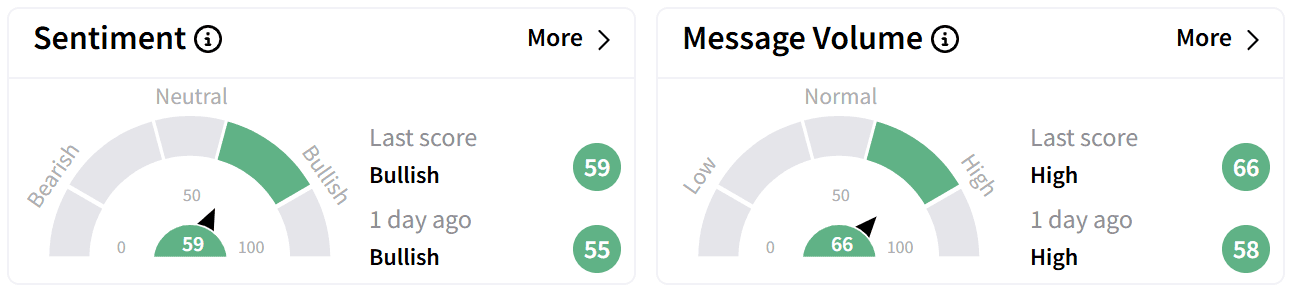

On Stocktwits, retail sentiment remained in the ‘bullish’ territory amid ‘high’ levels of chatter.

Many users dismissed the report as a fear-driven narrative timed ahead of month-end options expiry.

One user quipped that the company could sidestep U.S. tax concerns by relocating its headquarters to Puerto Rico.

MicroStrategy’s stock has consistently outpaced Bitcoin in returns, gaining 723% over the past year compared to Bitcoin’s 176%.

Year-to-date, the stock is up 23%, outperforming Bitcoin’s 14% rise.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2204154647_jpg_b295df5f6b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Norwegian_Cruise_jpg_ba826c7555.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_stock_jpg_1a4860daf4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229886652_jpg_a4903ce2cc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_resized3_jpg_d9e74e2821.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/tesla_cybercab_display_resized_jpg_c5beeba25b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)