Advertisement|Remove ads.

Midcap Bets: SEBI RA Aditya Thukral Flags These Two Stocks For Strong Gains In Next Two Months

SEBI-registered analyst Aditya Thukral has identified Page Industries and Asahi India as bullish candidates, citing strong technical setups.

Page Industries

Page Industries, the official licensee of innerwear brand Jockey, is showing strong bullish signals across both weekly and daily charts, including the formation of multiple cup patterns, Thukral said.

The daily chart displays a cup-and-handle formation, with a breakout supported by strong volume, indicating a significant move. The stock remains in a long-term and short-term uptrend, consistently forming higher highs and higher lows, he added.

It is also trading above key 50-, 100-, and 200-day exponential moving averages (EMA), reinforcing the trend's strength. The 14-period relative strength index (RSI) on both daily and weekly charts is near 60, suggesting room for further upside.

From an Elliott Wave perspective, signs of impulsive rallies indicate the beginning of a new bull market phase, the analyst noted.

Thukral recommends buying at current levels of ₹48,710 with a stop-loss at ₹44,200. The stock could hit ₹58,000 in the next two months, a 19% premium.

Alternatively, Thukral suggests selling the ₹44,000 PE (July 31) option at ₹150, with a stop-loss at ₹300.

Page Industries shares gained 2.48% year-to-date.

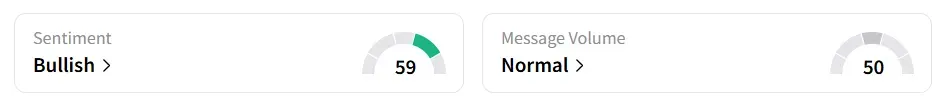

Retail sentiment on Stocktwits remained ‘bullish’ on this counter.

Asahi India

Asahi India is showing strong technical momentum with the formation of a cup pattern and an inverse head-and-shoulders pattern, both of which indicate bullish setups, the analyst noted.

Breakouts from these patterns occurred in the same week and were supported by strong volumes, indicating conviction in the move, he added.

The stock is trading above its 50-day, 100-day, and 200-day exponential moving averages (EMA), with the chart structure displaying higher highs and higher lows, further supporting the bullish outlook.

Additionally, the inverse head & shoulders breakout was confirmed by a similar move in the 14-period relative strength index (RSI).

While the RSI on daily charts is nearing the overbought zone, suggesting possible short-term consolidation, the weekly RSI still indicates room for further upside.

The analyst recommends taking up new positions at the ₹830 - ₹835 range, as the stock could reach ₹1,040 over the next two months, a 25% upside. He also cautions a stop loss at ₹735.

Asahi India shares have gained 8% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)