Advertisement|Remove ads.

Minneapolis Fed President Neel Kashkari Says Further Modest Rate Reductions ‘Appropriate’ In Coming Quarters

Federal Reserve Bank of Minneapolis President Neel Kashkari reportedly said on Monday that more rate cuts can be expected ahead with the 2% inflation target in sight.

"As of right now, it appears likely that further modest reductions in our policy rate will be appropriate in the coming quarters to achieve both sides of our mandate," Kashkari said in a speech, according to a Reuters report.

He added, "ultimately, the path ahead for policy will be driven by the actual economic, inflation and labor market data.”

Kashkari also said the current stance of monetary policy, with the federal funds rate range between 4.75% and 5%, remains restrictive of growth. “(The Fed) is in the final stages of bringing inflation down to our 2% target,” he said.

On Monday, major U.S. indices rose nearly 1% as investors got ready for big banks' earnings on Tuesday. The SPDR S&P 500 ETF Trust (SPY) was trading lower by nearly 0.15% while the Invesco QQQ Trust, Series 1 (QQQ) lost nearly 0.06% by afternoon.

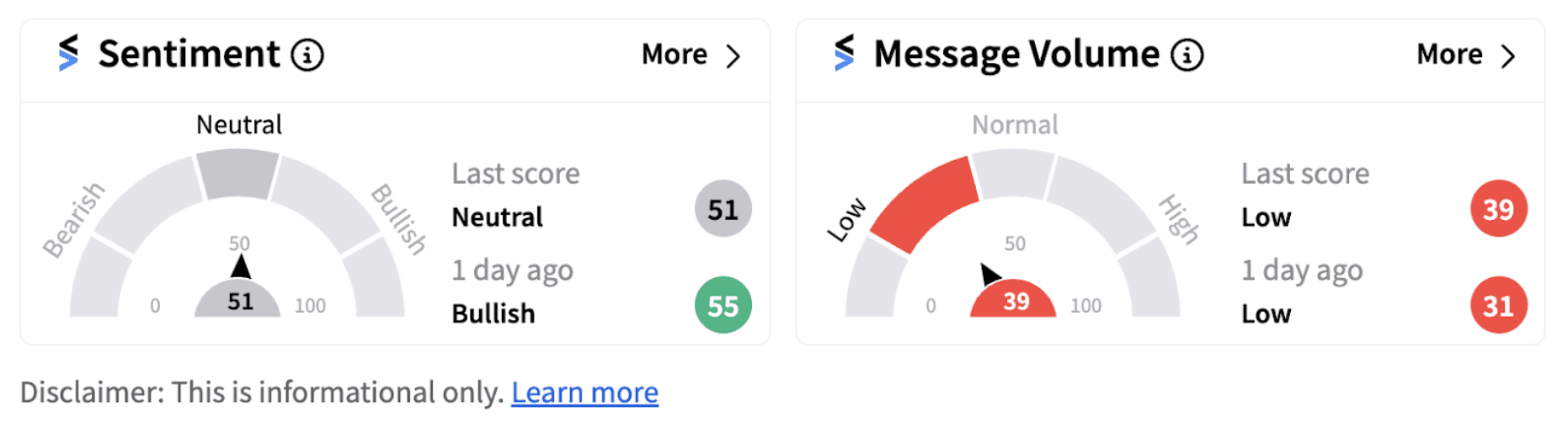

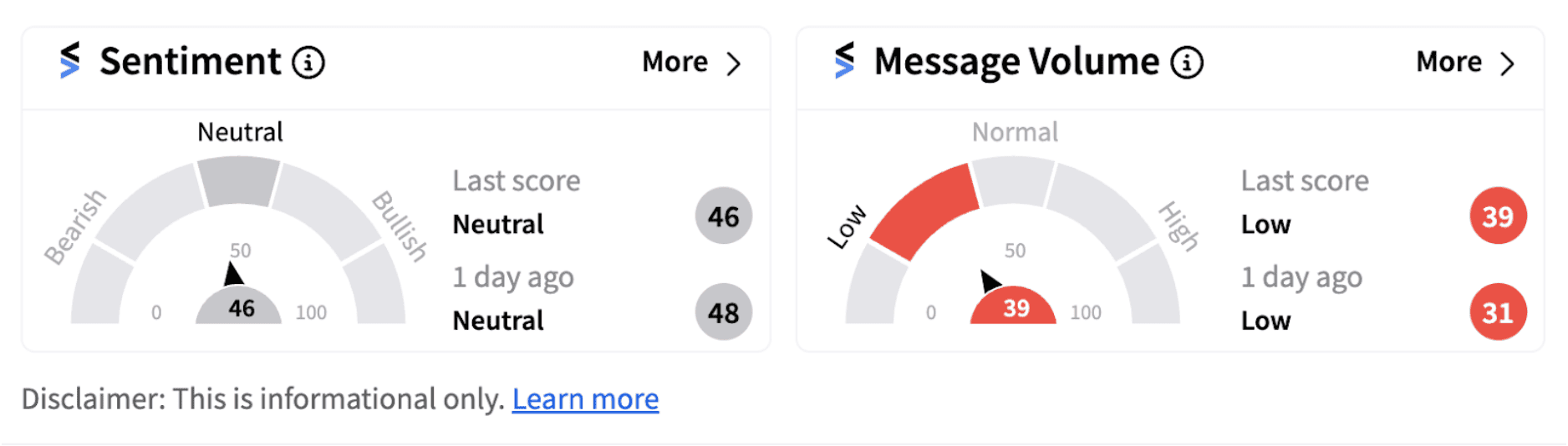

However, retail sentiment remained in the ‘neutral’ territory for both the ETFs on Monday.

Last week, Federal Reserve Bank of New York President John C. Williams had said it will be appropriate to continue the process of moving the stance of monetary policy to a more neutral setting over time.

The Fed official noted that with progress being made toward achieving price stability, “moving toward a more neutral monetary policy stance will help maintain the strength of the economy and labor market.”

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206295220_jpg_1057588802.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247614893_jpg_e1dcf2d2f6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sound_Hound_jpg_7961ee756a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2191702229_jpg_e9b50f268b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)