Advertisement|Remove ads.

MannKind Stock Surges After-Hours On Q4 Revenue Beat, Debt Reduction As Retail Investors Celebrate ‘Amazing Comeback’

Shares of MannKind Corporation jumped over 7% in after-hours trading after the biopharmaceutical company posted stronger-than-expected fourth-quarter revenue, further reduced its debt, and provided positive updates on its drug pipeline.

MannKind reported Q4 revenue of $76.8 million, surpassing analyst expectations of $74.4 million. Earnings per share (EPS) came in at $0.03, slightly below the consensus estimate of $0.04.

More significantly, the company made substantial progress in cleaning up its balance sheet, slashing its debt principal by $236 million to leave just $36 million in remaining convertible debt.

It ended 2024 with $203 million in cash, cash equivalents, and investments.

CEO Michael Castagna highlighted the company’s key achievements, including reaching an annual revenue run rate of $300 million and making advancements in its endocrine and orphan lung disease programs.

Within its pipeline, MannKind is progressing with Nintedanib DPI, which is moving into the next phase of development, and Clofazimine inhalation suspension for nontuberculous mycobacterial (NTM) lung disease, which is on track to meet interim Phase 3 enrollment targets by late 2025.

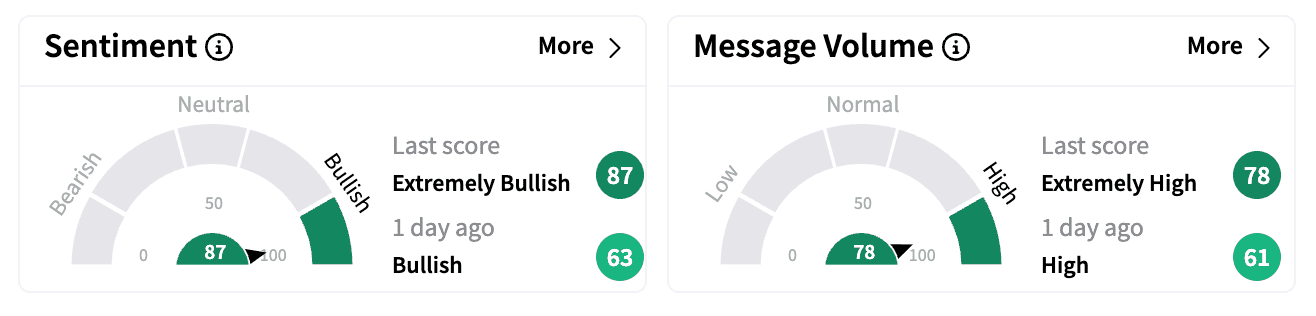

Retail sentiment on Stocktwits turned ‘extremely bullish’ following the earnings release, with the sentiment score hitting its highest level in a month.

Message volume nearly quadrupled over the past 24 hours as investors reacted to the company’s financial turnaround and pipeline progress.

One trader hailed the stock as an “amazing comeback story,” citing debt reduction, cash reserves, and a growing product lineup as key drivers of optimism.

Another pointed to MannKind’s 43% year-over-year revenue increase as a standout metric and noted the anticipated pediatric NDA submission in the first half of 2025 as a potential growth catalyst.

During the earnings call, Castagna emphasized the company’s disciplined capital allocation strategy, saying that paying down debt was a top priority.

He noted that the next key focus would be launching pediatric applications of MannKind’s flagship inhalable insulin, Afrezza, while also funding the ongoing development of its clofazimine and nintedanib trials.

Looking ahead, Castagna reiterated confidence in Afrezza’s growth potential, suggesting it could exceed $200 million in annual revenue within the next 18 to 24 months.

MannKind shares remain down more than 15% year-to-date, reflecting broader market concerns and past volatility. However, with a strengthened balance sheet and promising pipeline developments, some investors see a turnaround taking shape.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218096416_jpg_9d469a2ec6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)