Advertisement|Remove ads.

Molina Gets A Price Target Cut After Slashing Full-Year Guidance: Retail Sentiment Slips Marginally

BofA analyst Kevin Fischbeck on Tuesday lowered the firm's price target on Molina Healthcare (MOH) to $248 from $309 after the company slashed second-quarter and full-year earnings guidance.

The analyst kept an ‘Underperform’ rating on the shares, as per TheFly.

Molina, a health insurance firm, lowered its full-year 2025 and second-quarter adjusted earnings forecast to reflect higher medical cost pressures on Monday.

For Q2 2025, the company now expects adjusted earnings of $5.50 per share, below a mean analyst estimate of $6.21, according to data from Fiscal AI.

Molina expects medical cost pressures to persist into the second half of the year and lowered its full-year 2025 adjusted earnings to a range of $21.50 to $22.50 per share, down from its previous estimate of $24.50.

“The short-term earnings pressure we are experiencing results from what we believe to be a temporary dislocation between premium rates and medical cost trend which has recently accelerated,” said CEO Joseph Zubretsky.

However, the company does not anticipate changes to its long-term business outlook, even with proposed changes to the federal budget affecting Medicaid.

BofA, however, noted that the issues in Medicaid and exchanges are "not a surprise" after Centene Corp (CNC) pulled its guidance last week due to an expected fall in revenue under plans associated with the Affordable Care Act, or Obamacare, coupled with a rise in medical cost trends within its Medicaid business.

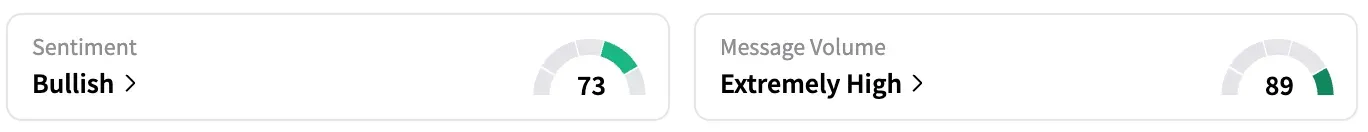

On Stocktwits, retail sentiment around Molina fell from ‘extremely bullish’ to ‘bullish’ territory over the past 24 hours while message volume remained at ‘extremely high’ levels.

According to data from Koyfin, eight of 17 analysts covering Molina rate it ‘Buy’ or higher, eight rate it a ‘Hold,’ while one has a ‘Strong Sell’ rating. The average price target on the stock is $340.49.

MOH stock is down by 20% this year and by about 21% over the past 12 months.

Read Next: Auto Group Chief Says Trump’s Megabill Is A Win For Chinese EV Makers: Report

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2164981884_1_jpg_100f5d0da3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_inflation_resized_f8af31ca5a.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2258839311_jpg_35f0914ce1.webp)