Advertisement|Remove ads.

Health Insurer Molina Lowers Full Year Earnings Guidance Over Higher Medical Costs Across Industry

Health insurance firm Molina Healthcare, Inc. (MOH) on Monday lowered its full-year 2025 and second-quarter adjusted earnings forecast to reflect higher medical cost pressures.

For Q2 2025, the company now expects adjusted earnings of $5.50 per share, below a mean analyst estimate of $6.21, according to data from Fiscal AI.

The company expects medical cost pressures to persist into the second half of the year and lowered its full-year 2025 adjusted earnings to a range of $21.50 to $22.50 per share, down from its previous estimate of $24.50.

“The short-term earnings pressure we are experiencing results from what we believe to be a temporary dislocation between premium rates and medical cost trend which has recently accelerated,” said CEO Joseph Zubretsky.

However, the company does not anticipate changes to its long-term business outlook, even with proposed changes to the federal budget affecting Medicaid.

“As we are still performing near our long-term target ranges, nothing, including the potential impacts of the budget bill, has changed our outlook for the long-term performance of the business,” the CEO added.

Molina is expected to report its Q2 results after the market closes on July 23.

Last week, health insurer Centene Corp (CNC) withdrew its full-year guidance due to an expected fall in revenue under plans associated with the Affordable Care Act, or Obamacare, coupled with a rise in medical cost trends within its Medicaid business.

Insurer UnitedHealth Group (UNH) also withdrew its guidance in May, saying medical expenditures are expected to be higher than initially anticipated.

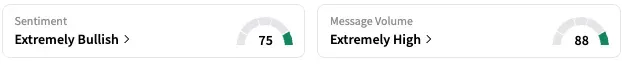

On Stocktwits, retail sentiment around MOH stayed unchanged within the ‘extremely bullish’ territory over the past 24 hours, coupled with ‘extremely high’ message volume.

MOH stock is down by 18% this year and by about 19% over the past 12 months.

Read Next: CoreWeave Doubles Down On AI Ambitions With Power-Heavy Core Scientific Merger

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2260447662_jpg_cd246b74f6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2254924116_jpg_d54ffea07e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2228900989_jpg_e94daec744.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_Red_OG_jpg_d64521f99a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)