Advertisement|Remove ads.

Molina Healthcare Stock Plunges 19% After-Hours On Earnings Miss, Guidance Cut — Retail Traders Call It ‘Cheap’

- Molina posted adjusted earnings of $1.84 per share for Q3, less than half of Koyfin’s $3.89 estimate, as medical costs surged across Medicaid, Medicare, and Marketplace businesses.

- The company lowered its 2025 adjusted EPS outlook to about $14 from a prior implied $19, while slightly raising full-year premium revenue guidance to $42.5 billion.

- On Stocktwits, retail traders were upbeat despite the sharp drop, describing the selloff as a potential buying opportunity and pointing to strong revenue growth.

Shares of Molina Healthcare fell 19% in after-hours trading on Wednesday after the health insurer reported weaker-than-expected third-quarter (Q3) earnings and slashed its full-year profit outlook, citing higher-than-anticipated medical costs across its major business segments.

Earnings Miss And Margin Pressure

Molina posted adjusted earnings of $1.84 per share, sharply below the Koyfin estimate of $3.89, while GAAP earnings per share (EPS) came in at $1.51, missing the projection of $3.31. Revenue rose 12% from a year earlier to $11.48 billion, slightly above the forecast of $10.98 billion, supported by higher premiums and member growth.

Operating income dropped 20.6% to $392 million, just above Koyfin’s estimate of $311 million, while earnings before interest, taxes, depreciation, and amortization (EBITDA) declined 23% year-on-year to $450 million, topping the projection of $346.6 million.

The company’s medical care ratio (MCR), which is the share of premium revenue spent on medical claims, increased to 92.6% from 89.2% a year earlier. The Marketplace business saw the steepest deterioration, with MCR rising to 95.6% amid what the company described as “unprecedented medical cost trends.”

Total membership rose to 5.6 million as of Sept. 30, up 30,000 from a year earlier, including 713,000 Marketplace members, up from 410,000 last year.

“The headline for the quarter is that approximately half of our underperformance is driven by the Marketplace business, and that Medicaid, while experiencing some pressure, is producing strong margins,” said CEO Joseph Zubretsky.

Guidance Cut

Molina lowered its full-year 2025 adjusted earnings forecast to about $14 per share, down from a previous implied view near $19 and below Wall Street’s consensus of $18.62. The downgrade came as Molina reiterated its full-year guidance for adjusted earnings of $11.90 per share. The health insurer attributed the improved profitability to high levels of utilization across its Medicaid, Medicare and Marketplace businesses.

For the fourth quarter, Molina now expects to earn about $0.35 per share, which would be helped by $3.00 per share of earnings from Medicaid and hurt by about $2.65 per share in losses from Medicare and Marketplace.

Molina's full-year guidance for premium revenues rose to $42.5 billion, up 10% from the year-ago period, as the insurer continues to expand its membership.

Outlook

For 2026, the company expects adjusted earnings per share to roughly match 2025 levels, with reduced exposure to the Marketplace business and expectations for that segment to at least break even.

Stocktwits Traders See Bargain Potential

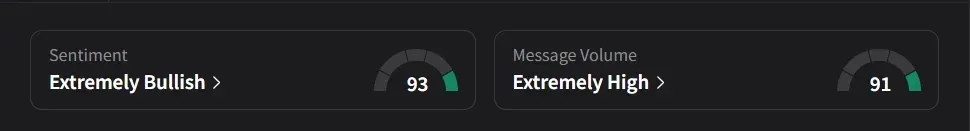

On Stocktwits, retail sentiment for Molina was ‘extremely bullish’ amid a 1,633% surge in 24-hour message volume.

One user said they viewed the selloff as a buying opportunity, describing the stock as “cheap” after the drop.

Another user was more upbeat, noting that while costs were high, the company’s rising revenue was a positive sign and that increased medical procedures before year-end were expected.

Molina’s stock has declined 33% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_changpeng_zhao_binance_CEO_OG_jpg_1f2a158765.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263411662_jpg_efc7c78da8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2201668075_jpg_cae68c6d02.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2213700945_jpg_100e788722.webp)