Advertisement|Remove ads.

Monolithic Power Stock Surges Pre-Market On Q4 Earnings Beat, Record Annual Revenue: Retail Celebrates

Monolithic Power Systems Inc. (MPWR) stock surged more than 8% in pre-market trading Friday, set to reach a two-month high, after the company reported stronger-than-expected fourth-quarter earnings and issued an upbeat outlook for the first quarter of 2025.

The power management solutions provider reported earnings per share (EPS) of $4.09, surpassing the analyst consensus of $3.98, according to Stocktwits data.

Revenue for the quarter climbed 36.9% year-over-year (YoY) to $621.7 million, exceeding estimates of $608.07 million.

For the first quarter of 2025, the company expects revenue between $610 million and $630 million, well above the consensus forecast of $600 million on Koyfin.

The company’s growth was driven by gains across key business segments. Enterprise Data revenue surged 51.2% year-over-year to $194.9 million, while Automotive revenue rose 43% to $128.4 million.

“Our proven, long-term growth strategy remains intact as we continue our transformation from being a chip-only semiconductor supplier to a full-service, silicon-based solutions provider,” said CEO and founder Michael Hsing.

For the full year 2024, Monolithic Power achieved record revenue of $2.2 billion, up 21.2% year-over-year—marking its 13th consecutive year of revenue growth.

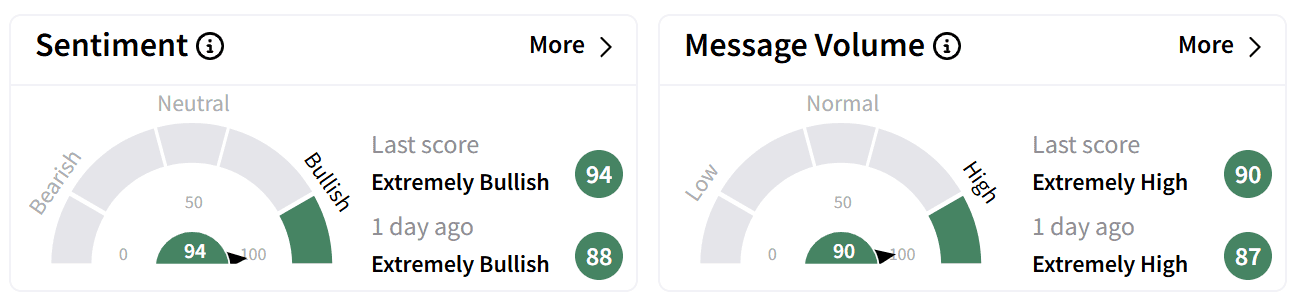

On Stocktwits, retail sentiment around Monolithic Power edged higher within the ‘extremely bullish’ zone as chatter remained at ‘extremely high’ levels.

Users on the platform cheered the earnings and guidance.

Monolithic also announced a 25% increase in its quarterly dividend to $1.56 per share and authorized a new $500 million stock repurchase program over the next three years.

The stock has gained 1.5% over the past year and is up nearly 10% year-to-date. If pre-market gains hold, it will have doubled its gains for the year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)