Advertisement|Remove ads.

Microchip Stock On Track To Hit 4-Year Low After Q3 Earnings Miss, Weak Guidance: Retail Stays Bullish

Microchip Technology Inc. (MCHP) stock dropped nearly 6.5% in pre-market trading on Friday after the semiconductor company missed third-quarter earnings and revenue expectations.

The chipmaker also provided weaker-than-expected guidance for the fourth quarter, pushing its stock toward a four-year low.

Microchip’s stock was last seen trading at these levels in Sept. 2020.

The company reported earnings per share (EPS) of $0.20 for the third quarter, falling short of the analyst consensus of $0.29.

Revenue declined 41.9% year-over-year to $1.03 billion, missing estimates of $1.05 billion.

The company cited broad-based weakness across major geographies and product categories, including microcontrollers and analog chips.

For the fourth quarter of fiscal 2025, Microchip EPS to be between $0.05 and $0.15, well below the Koyfin consensus estimate of $0.17.

Revenue is projected to range between $920 million and $1 billion, with the midpoint falling below the estimated $996 million.

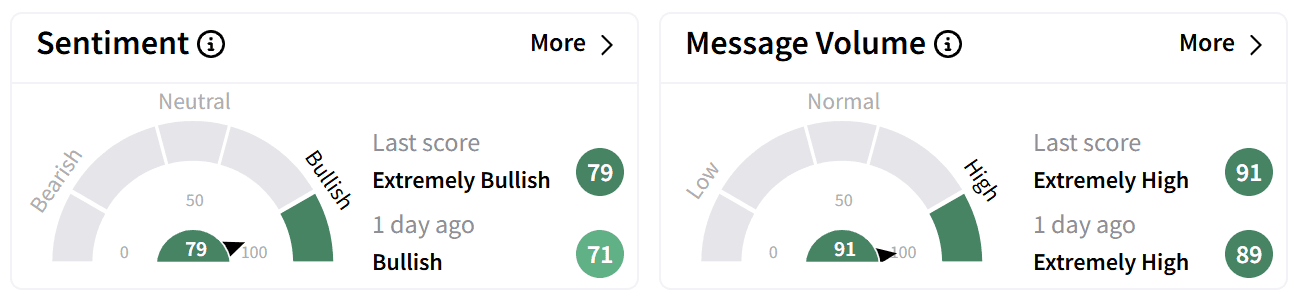

On Stocktwits, retail sentiment around the stock improved to ‘extremely bullish’ from ‘bullish’ a day ago as chatter remained at ‘extremely high’ levels.

Some traders drew comparisons to Skyworks Solutions (SWKS), which lost a quarter of its market value on Thursday after reporting weaker demand from Apple.

Another correctly anticipated that the stock would plummet after the earnings call.

Microchip ended the quarter with 266 days of inventory, significantly above its target range of 130 to 150 days.

In response, during the earnings call, the company said it is implementing a nine-point efficiency plan, which includes resizing its manufacturing footprint and reducing excess stock.

The company has introduced a new generation of 64-bit RISC-V processors with AI capabilities, which it says have received strong initial customer interest. It also expanded its Wi-Fi portfolio with 20 new products aimed at improving secure wireless connectivity.

Management said the company is focusing on strengthening relationships with its top 1,000 customers, aiming to enhance design support and product integration.

Microchip’s stock has dropped over 37% in the past year and is down more than 8% in 2025 so far.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: Cloudflare Stock Heads To Over 3-Year Highs On Q4 Earnings Beat, Retail Debates 2025 Outlook

/filters:format(webp)https://news.stocktwits-cdn.com/large_jamieson_greer_jpg_e66ba6dd7a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_stock_jpg_9eab8bde17.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2225993084_jpg_3889c04879.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259461476_jpg_bc073e334e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_540198451_jpg_3e5f3d8ee7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_treasury_yields_jpg_074c6369d6.webp)