Advertisement|Remove ads.

Moody’s Lifts Royal Caribbean Out Of Junk Status, But Retail Traders Are Not Celebrating Just Yet

Moody's Ratings has dropped its junk rating on Royal Caribbean Cruises (RCL) debt, months after an upgrade from S&P Global Ratings.

Moody's upgraded the senior unsecured rating to 'Baa3' from 'Ba1' and the commercial paper rating to 'P-3' from 'Not Prime'.

It also withdrew the ‘Ba1’ corporate family rating and the ‘Ba1-PD’ probability of default rating, indicating a positive outlook for the cruise company.

The ratings company said the "demand for cruises will continue to grow, leading to gains in revenue and earnings and a strengthening business profile with improved credit metrics."

Royal Caribbean lost investment-grade status in 2020, just as the COVID-19 pandemic temporarily halted the cruise business.

Demand has been consistently upward in recent years. Royal Caribbean raised its annual profit forecast in April, citing strong demand and low fuel prices.

Moody's said the company's expanded offerings, booking growth, and management's focus on growing the business are behind its upgrade.

In February, S&P Global Ratings upgraded Royal Caribbean’s credit rating to 'BBB-' from 'BB+', citing strong forward bookings and anticipated sustained improvement in credit measures.

In its quarterly report last month, Royal Caribbean said S&P's upgrade reflected "the strength of its financial position, consistent performance and disciplined capital allocation strategy."

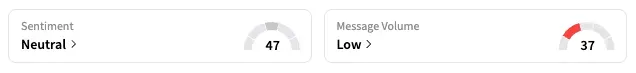

On Stocktwits, the retail sentiment for the company was in the 'neutral' territory.

One user recommended exposure to the stock and called it "Best of the breed."

Royal Caribbean shares are up 10% year to date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250241035_jpg_937df85f43.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Applied_Digital_jpg_95c1bba239.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_generic_resized_jpg_3444b70edf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217856934_jpg_29efdc61ed.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_New_York_Times_resized_jpg_37d8dd3b33.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_meta_OG_jpg_187c6126ee.webp)