Advertisement|Remove ads.

MoonLake Therapeutics Stock Sparks Retail Frenzy Ahead Of New York Summit — Traders See 'Nonstop Catalysts' Through 2026

- Retail traders turned ‘extremely bullish’ on MoonLake as anticipation builds for potential program updates at the upcoming Inflammatory Skin Disease Summit in New York.

- A recently circulated company deck outlining expected regulatory meetings and trial readouts has fueled expectations for a steady flow of milestones.

- Stocktwits users highlighted growing optimism that 2026 could be a turnaround year for the company.

Retail chatter around MoonLake Therapeutics spiked on Wednesday as traders looked ahead to potential updates the company could discuss at the 6th Inflammatory Skin Disease Summit, running Nov. 12–15 in New York. The anticipation follows the circulation of a recent MoonLake deck outlining upcoming milestones for its dermatology and rheumatology programs.

PPP Program

MoonLake’s presentation lays out several steps for palmoplantar pustulosis (PPP), a painful inflammatory skin disease with no approved treatments in the U.S. or Europe.

According to the deck, the company plans to advance sonelokimab into a Phase 3 study involving 400 patients. MoonLake said it has an FDA meeting plan to discuss the Phase 3 design. The presentation also notes that a separate Bimekizumab comparator trial is expected to begin in the fourth quarter (Q4).

The company reiterated estimates showing PPP could reach a $4 billion–$5 billion market by 2038, based on projected patient growth.

HS Program

For hidradenitis suppurativa (HS), MoonLake said a Type B FDA meeting is scheduled for Dec.15, with briefing materials already submitted. The meeting is expected to provide clarity on the potential approval pathway for the drug in HS.

The company also outlined additional planned readouts, including Week 52 long-term VELA data and subsequent regulatory interactions tied to its biologics license application (BLA). The company’s timeline shows that its HS BLA submission remains on track.

Adolescent HS Program

MoonLake’s adolescent program, VELA-TEEN, also features upcoming milestones.

The company said the Phase 3 study is expected to reach its BLA data cut in the second quarter of 2026. Early interim analyses showed continued progression in response rates through Week 24, with the company noting that the program continues as planned.

Rheumatology Programs

MoonLake also stated that Phase 3 psoriatic arthritis data and Phase 2 axial spondyloarthritis results are both expected in 2026.

Stocktwits Users See MoonLake As A ‘Catalyst Machine’

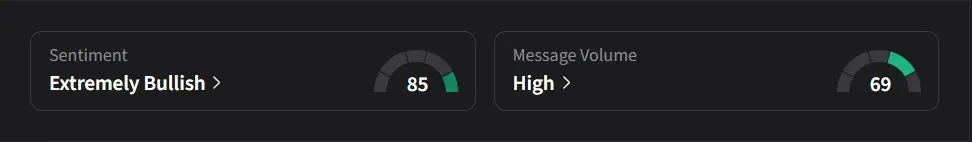

On Stocktwits, retail sentiment for MoonLake turned ‘extremely bullish’ amid ‘high’ message volume.

One user said the last MoonLake conference had been followed by several analyst upgrades and suggested that institutions.

Another user described MoonLake as “the comeback story of 2026.” A third user said a slide in the company’s deck signaled that MoonLake would be releasing confirmed data, FDA decisions, and trial readouts every 30–60 days, calling it “a nonstop catalyst machine through 2026.”

A fourth user said the stock had traded around $65 before the newest evidence and argued it would move past that level as more milestones approach, calling MoonLake “the best buy in biopharma.”

MoonLake’s stock has declined 76% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)