Advertisement|Remove ads.

Most Stocktwits Users View Dell’s Dividend Hike And Augmented Stock Buyback Plan As Sign Of Confidence In Growth

Dell Technologies, Inc’s (DELL) shares fell 4.70% on Friday after the computer and peripherals maker reported mixed quarterly results. However, retail investors are largely bullish on the stock.

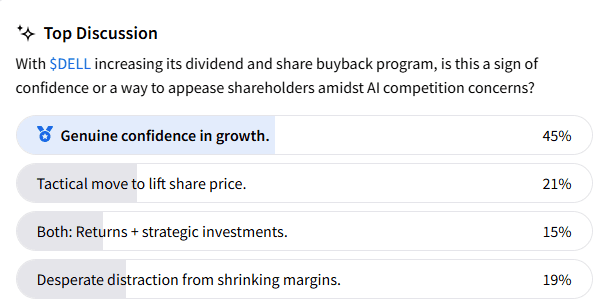

A Stockwits poll asked users regarding their views on the Round Rock, Texas-based company’s dividend hike and augmented stock buyback plan.

Dell raised its annual dividend by 18% to $2.10, with the first quarterly distribution of $0.525 to be paid out on May 2. The company also announced board approval for a $10 billion increase to the existing stock repurchase authorization.

Most respondents, but not a majority (45%), see Dell’s latest capital allocation strategy reflecting its "genuine confidence in growth."

A little over one-fifth of the respondents (21%) said it was a tactical move to lift the stock price. A far less (15%) see the motive as a combination of “returns and strategic investments," and 19% said it was a ploy to distract investor attention away from shrinking margins.

Following the fourth quarter results of the fiscal year 2025, Morgan Stanley said the results were better than feared across the board.

Analyst Erick Woodring noted that the company issued stronger-than-expected fiscal year 2026 guidance and spoke of accelerated momentum in artificial intelligence (AI) servers.

The analyst sees Dell as a beneficiary of AI adoption and scale.

Woodring maintained his 2026 earnings per share (EPS) estimate for Dell at $9.50. He added that the path to over $10 in EPS is clearer after the fourth-quarter results.

Morgan Stanley has an ‘Overweight’ rating and $128 price target for Dell stock.

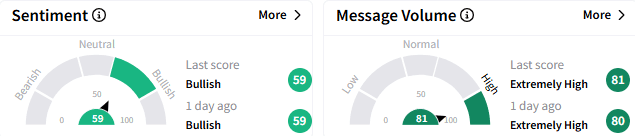

On Stocktwits, sentiment toward the stock remains ‘bullish’ (59/100), with the message volume at an ‘extremely high’ level.

Most users think Dell is “acutely undervalued,” with one suggesting that they will accumulate more shares this week.

Dell stock has lost over 10% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2226817028_jpg_d2fd9156db.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_elerian_resized_jpg_49303b41ee.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_netflix_paramount_warner_bros_jpg_c959c8a9e4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_original_jpg_285085becb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_atm_original_jpg_afc73e9be7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262712431_1_jpg_6f471d2542.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)