Advertisement|Remove ads.

Retail Traders Divided On March Market Moves After February Dip — Most Want To Sit Out Or Go For Buffett-Style Cash Play

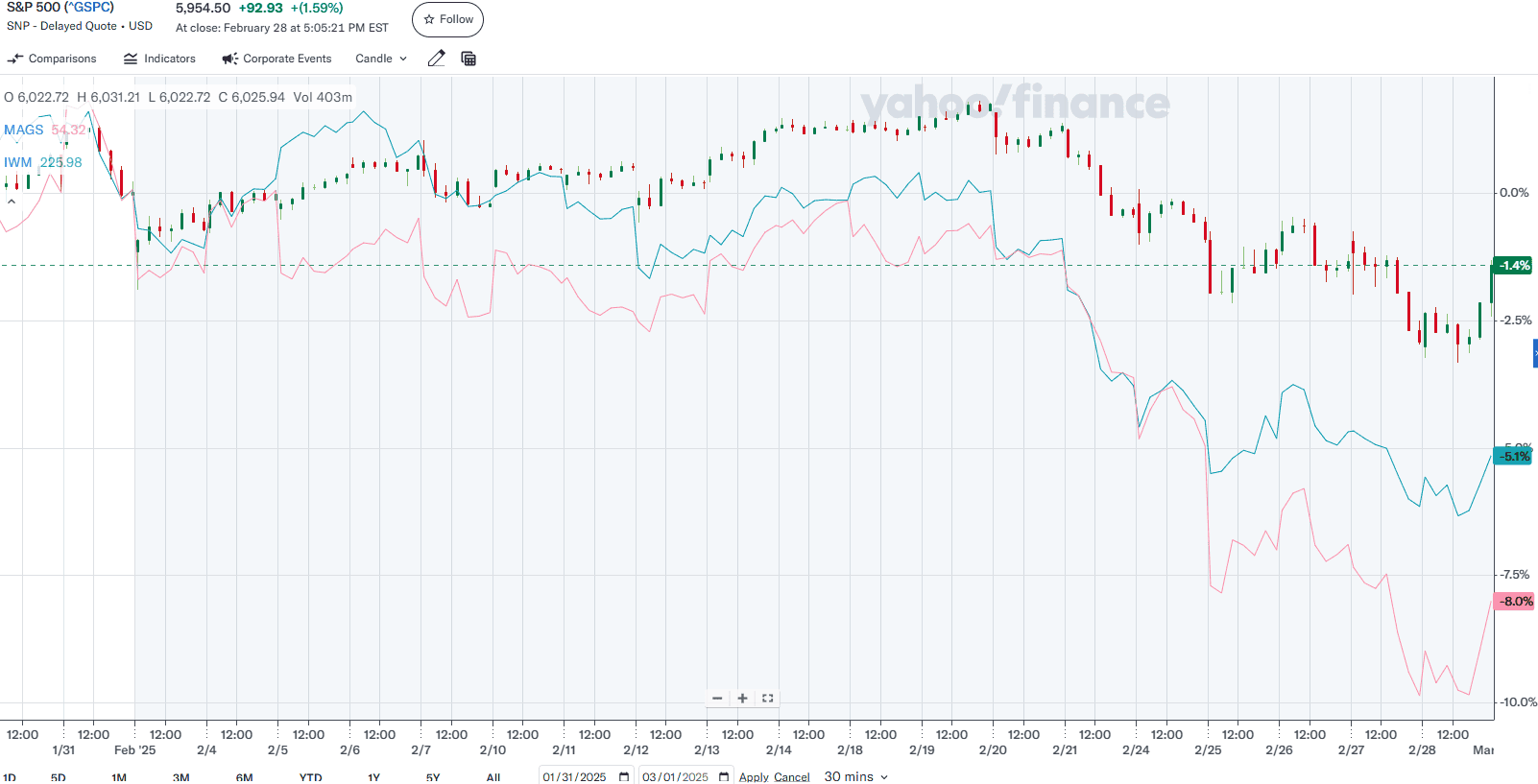

The broader market ended February with a loss, as the S&P 500 slipped 1.42% for the month. Still, the index hit intraday and closing highs of 6,147.43 and 6,144.15, respectively.

Concerns over Trump-era tariffs, uncertainty around the Federal Reserve’s rate outlook, and mixed earnings weighed on stocks, dragging the market lower.

Among market-cap groups, the Roundhill Magnificent Seven ETF (MAGS), which tracks the performance of the so-called ‘Magnificent Seven’ stocks, dropped nearly 8%, while the iShares Russell 2000 ETF (IWM), which tracks small-cap stocks, fell a more modest 5%.

Chart Courtesy of Yahoo Finance

As the new month begins, retail sentiment remains mixed.

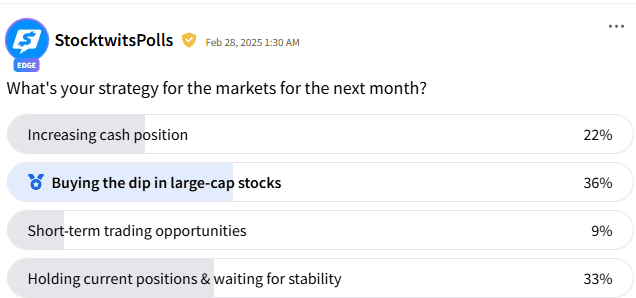

A Stocktwits poll found that 36% of respondents are preparing to buy the dip in large-cap stocks, while 33% plan to stay on the sidelines, holding their positions and waiting for stability.

Meanwhile, 22% want to boost their cash reserves — a strategy echoed by Warren Buffett, whose Berkshire Hathaway (BRK-A, BRK-B) amassed a record $334.2 billion in cash by the end of Q4.

Only 9% of respondents are eyeing short-term trading opportunities as markets brace for key catalysts, including the Federal Open Market Committee meeting on March 17-18.

In addition to the rate decision, the central bank will release its updated “Summary of Economic Projections,” which includes the Fed’s rate trajectory forecast, aka the dot-plot curve.

The other key data releases include the February non-farm payroll report, which is due Friday, and a handful of inflation and consumer sentiment readings.

Larry Tentarelli, Chief Technical Strategist at Blue Chip Daily Trend Report, remains cautiously optimistic heading into March.

He pointed out that economic concerns rattled both stock and bond markets in February, with traditionally defensive sectors — real estate, consumer staples, utilities, and healthcare — leading S&P 500 performance over the past month.

Meanwhile, the technology sector and the Nasdaq 100 have underperformed year-to-date, with six of the ‘Magnificent Seven’ stocks down YTD, except for Meta Platforms (META).

The strategist said, “We believe there is [a] valid concern in the markets about the amount of money being spent on Artificial Intelligence datacenters and capex, considering news from China AI startup Deep Seek in late January.”

He expects these stocks to reach support at some point.

As tariffs and the Russia-Ukraine war continue to dominate headlines, Tentarelli recommended increasing exposure to healthcare, communication services, and financials, including Eurozone banks, select technology stocks and China large caps.

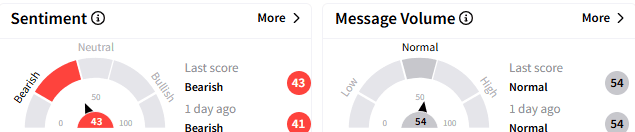

Retail sentiment toward the SPDRT S&P 500 ETF Trust (SPY) remained ‘bearish’ (43/100) and the message volume stayed ‘normal.’

A bearish user pointed to the relative strength index (RSI) on a five-year chart and said the SPY is ripe for a correction.

Another user based their bearish view on fears that a recession may be looming.

The SPY ETF ended Friday’s session up 1.56% at $594.19. The ETF is up 1.4% YTD, although it is trading 3.10% off its Feb. 19 intraday high of $613.23.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Apple_Siri_jpg_30dce91b4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2257248307_jpg_6720435e43.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2248586785_jpg_9c6ef18a07.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_btc_x_96cc54b79b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_coinbase_2_jpg_59a44ebea9.webp)